Account Aggregator Ecosystem:

- The financial landscape is rapidly evolving, with technological advancements paving the way for more efficient, secure, and user-friendly financial services. One such innovation is the Account Aggregator (AA) ecosystem, a framework designed to revolutionize how financial data is shared and utilized. Account Aggregators serve as intermediaries that collect and manage financial data from multiple sources, allowing individuals and businesses to have a consolidated view of their financial information. This system not only enhances transparency and convenience but also strengthens data security by ensuring that data sharing is consent-based and controlled by the user.

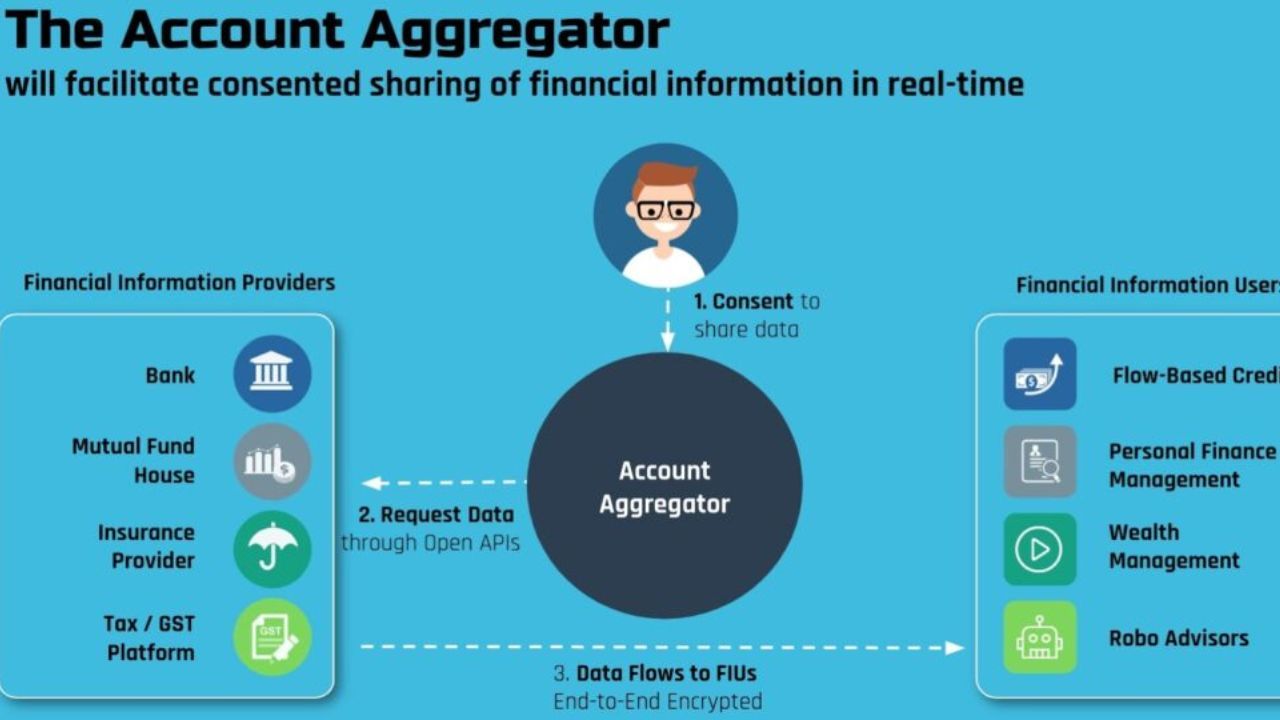

- The AA ecosystem comprises various stakeholders, including Financial Information Providers (FIPs), Financial Information Users (FIUs), the Account Aggregators themselves, and the end-users. FIPs include banks, non-banking financial companies (NBFCs), mutual funds, insurance companies, and other financial institutions that hold user data. FIUs are entities that consume this data to offer financial products and services, such as lenders, personal finance managers, and wealth managers. Account Aggregators act as a bridge between FIPs and FIUs, facilitating the secure transfer of data with user consent.

- The ecosystem is governed by regulations and standards set by regulatory bodies like the Reserve Bank of India (RBI), ensuring that all participants adhere to strict data privacy and security norms. The introduction of AAs is expected to drive financial inclusion, foster innovation in financial services, and empower users with greater control over their financial data.

Account Aggregator Model:

- The Account Aggregator model is built on the principles of user consent, data minimization, and interoperability. It operates as a consent-based data sharing framework where users authorize the transfer of their financial data from FIPs to FIUs through an Account Aggregator. This model ensures that data is shared only with the explicit consent of the user, enhancing privacy and security.

The key components of the AA model include:

- User Consent: Users provide explicit consent for sharing their financial data. The consent framework is designed to be granular, allowing users to specify what data is shared, with whom, and for how long.

- Data Minimization: Only the necessary data required for a specific purpose is shared. This reduces the risk of data misuse and enhances privacy.

- Interoperability: The AA ecosystem is designed to be interoperable, meaning that data can be shared across different financial institutions and platforms seamlessly. This interoperability is achieved through standardized protocols and APIs.

- Security and Privacy: Data shared through the AA framework is encrypted and protected by robust security measures. The model ensures that data is shared in a secure manner and only with authorized entities.

- Transparency and Control: Users have complete visibility and control over their data. They can monitor who has access to their data and can revoke consent at any time.

The AA model aims to simplify financial management for users, reduce information asymmetry, and promote a more competitive and innovative financial services market.

How it Works:

The functioning of the Account Aggregator framework involves several steps, ensuring a secure and efficient process for data sharing:

- Registration: Users register with an Account Aggregator by providing their basic information and linking their financial accounts. This can be done through a mobile app or web portal provided by the AA.

- Consent Request: When a user needs to share their financial data with an FIU (e.g., applying for a loan), the FIU initiates a consent request through the AA. The user receives a notification detailing the data requested, the purpose, and the duration of access.

- User Consent: The user reviews the consent request and, if agreeable, provides consent through the AA's platform. This consent is digitally signed by the user, ensuring authenticity and non-repudiation.

- Data Fetching: Upon receiving user consent, the AA fetches the required data from the respective FIPs. This data is encrypted and securely transmitted to the AA.

- Data Sharing: The AA then shares the encrypted data with the FIU as per the user’s consent. The FIU decrypts the data and uses it for the specified purpose, such as assessing a loan application.

- Audit and Monitoring: Users can monitor all their consented data shares through the AA’s platform, ensuring transparency. They can also revoke consent if they no longer wish to share their data.

This streamlined process ensures that data sharing is efficient, secure, and entirely controlled by the user, enhancing trust in the financial ecosystem.

The following Account Aggregators are onboarded by Bank:

Our bank has partnered with several Account Aggregators to provide our customers with enhanced financial services. These AAs have been carefully selected based on their adherence to regulatory standards, data security measures, and user-centric approach. The AAs onboarded by our bank include:

- FinVu: Known for its robust security protocols and user-friendly interface, FinVu offers seamless integration with various financial institutions, making it easy for users to manage their finances.

- OneMoney: OneMoney is a pioneer in the AA ecosystem, offering a comprehensive platform that supports a wide range of financial services. Its focus on user consent and data privacy aligns perfectly with our bank's values.

- CAMs FinServ: CAMs FinServ leverages its extensive experience in the financial sector to provide reliable and secure data aggregation services. Their platform is designed to offer a smooth user experience, ensuring that data sharing is both easy and secure.

- Yodlee: A global leader in data aggregation, Yodlee brings its expertise to the Indian market with a robust AA platform. Their advanced analytics and data insights capabilities make them a valuable partner for our bank.

- Perfios: Perfios offers a highly secure and efficient AA platform, with a strong focus on user privacy. Their technology enables quick and accurate data sharing, enhancing the overall customer experience.

By partnering with these Account Aggregators, our bank aims to provide customers with a holistic view of their financial status, facilitate better financial planning, and offer personalized financial products and services.

Conclusion:

- The Account Aggregator ecosystem represents a significant leap forward in the realm of financial services, bringing about a paradigm shift in how financial data is managed and shared. By placing the user at the center of the data sharing process, AAs ensure that privacy, security, and user control are paramount. The adoption of the AA model promises to enhance financial inclusion, drive innovation, and foster a more competitive financial market.

- For users, this means greater transparency, easier access to financial services, and more personalized financial products tailored to their needs. For financial institutions, it offers the opportunity to innovate and provide better services, while also reducing operational inefficiencies.

- Our bank's collaboration with leading Account Aggregators underscores our commitment to embracing technological advancements and providing our customers with the best possible financial services. As the AA ecosystem continues to evolve, it will undoubtedly play a crucial role in shaping the future of the financial industry, making it more user-centric, secure, and efficient.

FAQs:

What is an Account Aggregator?

- An Account Aggregator facilitates the transfer of data from a Financial Information Provider (FIP) to a Financial Information User (FIU) with the user's explicit digital consent. No user's financial information is accessed, shared, or transferred without their explicit consent.

What is RBI approved Account Aggregator?

- Account Aggregators are granted the NBFC-AA license by the Reserve Bank of India (RBI). Initially, they receive an in-principle NBFC-AA license upon meeting the registration requirements established by the RBI.

What is an example of account aggregation?

- Indeed, various online banking services offer a consolidated view of multiple accounts, such as checking, savings, CDs, and brokerage accounts, on a single homepage for account holders. Additionally, personal finance software and apps like Quicken or Mint extend account aggregation services to users, allowing them to manage and monitor their finances comprehensively.

Is Account Aggregator safe?

- Finance Minister Nirmala Sitharaman reaffirmed on Thursday that customer data shared with account aggregators (AA) is entirely secure in India. Expressing concern over the sluggish progress of the AA scheme, she stated, "It is not as much progress as I would like to see."

What is SBI Account Aggregator?

- Account Aggregators use advanced technology to securely transfer individual's information among financial institutions, insurers, and mutual funds. This involves robust encryption and digital signatures for enhanced security.

Who are called aggregators?

- A term for someone or something that gathers materials from various sources is "aggregator."

Is Account Aggregator free or paid?

- The "per account" charge ranges from INR 0.30 to INR 9.90, depending on the type of account data being accessed.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App