Axis Bank Net Banking

Registering for Axis Bank Net banking services through the mobile app is simple and efficient. The app gives you access to a wide range of banking features from your smartphone, allowing you to perform transactions securely and conveniently anywhere, anytime.

Table of Contents

- How to Register for Axis Net Banking?

- Axis Mobile Banking Registration

- Benefits of Axis Bank Net Banking

- Axis Net Banking Login Process

- How to Reset Axis Bank Net Banking Password?

- How to Check Axis Bank Account Details?

- How to Transfer Funds via Axis Bank Net Banking?

- Fund Transfer Charges on Axis Bank Internet Banking

Axis Bank Internet Banking Registration

- Visit the Axis Bank Website: Go to the official Axis Bank website and navigate to the Net Banking login page.

- Click on 'Register Here': On the login page, click on the 'Register Here' link.

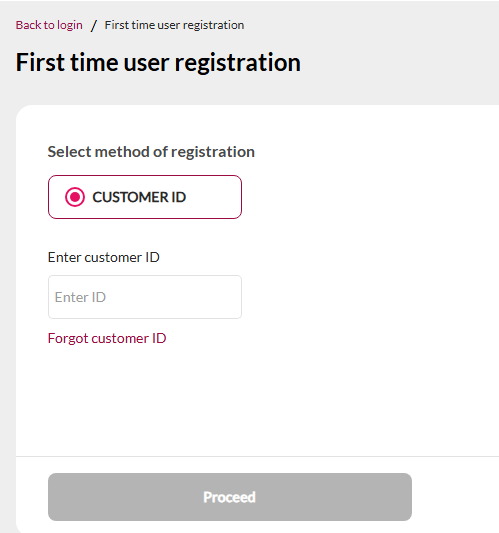

- Enter Customer ID: To proceed, you will need your Customer ID. This ID is mentioned in your welcome letter and on your checkbook. If you don't have it handy, you can send an SMS with the text 'CUSTID' to 56161600 to retrieve it.

- Choose Verification Method: For Savings or Current Accounts, select one of the following verification methods: Debit Card, OTP (One-Time Password), Email Link, or KYC details.

- Complete Registration: Follow the on-screen instructions to set your password and complete the registration process. You will need to set three security questions and their answers for added security.

- Login to Your Account: Once registered, you can log in using your Customer ID/Login ID and Password, Debit Card number ATM PIN, or OTP.

- Enable Netsecure: Enable Netsecure with SMS, 1-Touch Device, or Mobile App for enhanced security.

- Access Net Banking Services: After logging in, you can access various services such as fund transfers, bill payments, account statements, and more.

Axis Mobile Banking Registration:

- Download the App: Go to the Google Play Store (for Android devices) or the Apple App Store (for iOS devices) and search for "open by Axis Bank." Download and install the app.

- Open the App: Open the "Open by Axis Bank" app once installed.

- Login: Tap on the "Login" button. If you don't have an account yet, select the "Register" option.

- Enter Details: You will need to provide your name and accept the terms and conditions. Set a six-digit mPIN (mobile PIN) of your choice.

- Verify Your Details: The app will send an SMS to verify your details. Enter your name and accept the terms and conditions.

Complete Level 2 Registration: To use any feature on the app, authenticate using one of the following options:

- Internet Banking credentials: Enter your Login ID and password.

- Debit Card credentials: Enter your debit card number, expiry date, and ATM PIN.

- OTP: Enter your customer ID, Date of Birth, and PAN/Passport number (for resident/NRI respectively). Enter the two OTPs sent to your registered mobile number and email address.

- Access Features: Once registered, you can access various features such as fund transfers, bill payments, account statements, etc.

Benefits of Axis Bank Net Banking:

- 24/7 Access: Manage your finances anytime, anywhere.

- Convenience: Perform transactions without visiting the bank.

- Security: Enhanced security with two-step authentication.

- Variety of Services: Transfer funds, pay bills, recharge, and more.

Axis Net Banking Login Process

Once your account is registered, logging in is straightforward:

- Visit the Axis Bank Net Banking Website: Go to the Axis Bank Net Banking login page.

- Enter Customer ID and Password: Enter your Customer ID and the password you set during registration.

- Complete Two-Step Authentication: For added security, Axis Bank uses a two-step authentication process. You may be asked to enter an OTP (One-Time Password) sent to your registered mobile number or answer security questions.

- Access Your Dashboard: After completing the authentication steps, you'll be logged into your net banking dashboard, where you can manage your accounts and perform various transactions.

How to Reset Axis Bank Net Banking Password?

To reset your Axis Bank Net Banking password, follow these steps:

- Visit the Axis Bank Net Banking Login Page: Go to the official Axis Bank website and navigate to the net banking login page.

- Click on 'Forgot Password': On the login page, click on the 'Forgot Password' link.

- Enter Customer ID or Registered Mobile Number: You'll be prompted to enter your Customer ID or registered mobile number.

- Verify Your Identity: To verify your identity, you'll receive an OTP (One-Time Password) on your registered mobile number. Enter the OTP in the provided field.

- Set a New Password: Once your identity is verified, you'll be asked to set a new password for your net banking account.

How to Check Axis Bank Account Details?

- Open the App: Launch the "Open by Axis Bank" app on your mobile device.

- Log In: Enter your mPIN (mobile PIN) or use biometric authentication (fingerprint or face recognition) if enabled.

- Home Screen: After logging in, you'll be directed to the app's home screen. Here, you will see a summary of your accounts and their balances.

- View Detailed Account Information: Tap on the Account: Select the account you wish to view in detail. This will open a page with comprehensive information about the selected account.

- Account Summary: This page shows the account balance, recent transactions, and other details.

- Access Statements: If you need to view or download your account statements:

- Go to 'Accounts': From the bottom menu, tap on 'Accounts'.

- Select 'Statements': Choose the 'Statements' option to view or download your bank statements for a selected period.

- Transaction History: To view the transaction history:- Tap on the 'Transactions' tab to see a detailed list of all recent transactions made from your account.

- Additional Features: Navigate through the app to explore other features, such as fund transfers, bill payments, and more.

How to Transfer Funds via Axis Bank Net Banking?

Transferring funds through Axis Bank Internet Banking is a straightforward process. Here are the steps to guide you through it:

- Log in to Axis Bank Internet Banking: Visit the Axis Bank website and log in using your Customer ID and password.

- Navigate to 'Transfer Funds': Once logged in, go to the 'Transfer Funds' option under the 'Fund Transfer' section.

- Choose the Transfer Method: Select the method of transfer you want to use, such as NEFT (National Electronic Fund Transfer), RTGS (Real Time Gross Settlement), or IMPS (Immediate Payment Service).

- Enter Beneficiary Details: Fill in the beneficiary's name, account number, and IFSC code. Ensure all details are correct to avoid any errors.

- Enter Amount: Specify the amount you want to transfer.

- Verify and Confirm: Double-check all the entered details, then confirm the transaction.

- OTP Verification: For added security, you may be asked to enter an OTP (One-Time Password) sent to your registered mobile number.

- Complete the Transfer: Once verified, the transaction will be processed, and you'll receive a confirmation message.

Key Points to Remember:

- NEFT: Available from 8:00 AM to 6:30 PM on working days. Transactions made after 6:30 PM will be processed the next working day.

- RTGS: Ideal for large-value transactions, processed in real-time.

- IMPS: Suitable for instant fund transfers, available 24/7.

Fund Transfer Charges on Axis Bank Internet Banking

- NEFT (National Electronic Fund Transfer): ₹5 to ₹25 (depending on the amount transferred)

- RTGS (Real Time Gross Settlement): ₹25 to ₹50 (depending on the amount transferred)

- IMPS (Immediate Payment Service): ₹5 to ₹25 (depending on the amount transferred)

Account Maintenance Charges

- Savings Account: ₹150 to ₹600 per quarter (depending on the type of account)

- Current Account: ₹300 to ₹1,000 per quarter (depending on the type of account)

Other Charges

- Chequebook Request: ₹50 to ₹100 per chequebook

- Debit Card Annual Fee: ₹100 to ₹500 (depending on the type of card)

- ATM Transactions: ₹20 per transaction (beyond the free limit)

UPI Transaction Charges

- UPI Transactions: Generally free for peer-to-peer transactions, but interchange fees may apply for transactions through digital wallets.

Forex Card Charges

- Forex Card Issuance Fee: ₹299 to ₹499 (depending on the type of card)

- Reload Fee: ₹50 to ₹100 per reload

FAQs:

What is the login ID in Axis Bank?

- The login ID in Axis Bank is typically your Customer ID. This unique identification number is assigned to you when you open an account with Axis Bank. You can find your Customer ID on your welcome letter, cheque book, or account statement. If you don't have it handy, you can retrieve it by sending an SMS with the keyword 'CUSTID' to 56161600 from your registered mobile number.

How can I activate my Axis Net banking?

- To activate Axis net banking, visit the Axis Bank website or use the Axis Mobile App. Select the "Register" option, enter your customer ID and registered mobile number, and authenticate using the OTP. Set a password, and your net banking will be activated for use.

How do I register for online net banking?

- To register for online net banking, visit your bank's official website or app, select "New User" or "Register," and provide your customer ID and registered mobile number. Authenticate with an OTP, set a password, and follow the prompts to complete your registration.

How do I get the customer ID for the Axis Bank App?

- Visit the Axis Bank Website or App: Go to the Axis Bank website or open the Axis Mobile App.

- Select 'Forgot Login ID/Password': Find and click on the 'Forgot Login ID' or 'Forgot Password' option.

- Enter Required Details: Provide your registered mobile number, customer ID (Mentioned in your Welcome letter & Chequebook), and other requested information.

- Receive OTP: You will receive an OTP on your registered mobile number for verification.

- Create New Credentials: Follow the prompts to reset or create your login ID and password.

How to know Axis Bank net banking password?

If you've forgotten your Axis Bank net banking password or need to reset it, follow these steps:

- Go to the Axis Bank Net Banking Login Page.

- Click on 'Forgot Password'.

- Enter Your Customer ID or Registered Mobile Number.

- Enter the OTP sent to your registered mobile number.

- Set a New Password.

How do I find my customer ID?

- As mentioned in your Welcome letter, Chequebook, and Axis Bank customers can get their login ID by sending an SMS with 'CUSTID' to 56161600 (from a registered mobile number). Choose a verification method: Debit Card, OTP, email link, or KYC details for Savings or Current Accounts.

How can I check my Axis Bank account details?

Axis Bank Missed Call Service

- Toll-Free Number: Dial 1800-419-5959 to check your account balance.

- Activation: Send an SMS with 'BAL' to 1800-419-5959 and give a missed call to the toll-free number to receive your balance via SMS.

How can I activate my Axis Bank mobile banking?

To activate Axis Bank mobile banking:

- Download App: Install the "Open by Axis Bank" app.

- Register/Login: Open the app and log in or register with your details.

- Complete Verification: Verify via Internet Banking, Debit Card, or OTP.

- Set mPIN: Set a six-digit mobile PIN (mPIN).

How can I activate my Axis account online?

To activate your Axis Direct account, here's what you need to do:

- Enter Registered Mobile/PAN: Begin by entering your registered mobile number or PAN.

- Click Enter OTP: Click on the 'Enter OTP' button.

- OTP Sent: An OTP will be sent to your registered mobile number and email address.

- Enter OTP: Enter the OTP received on your mobile and email.

- Set Desired Password: Create a password of your choice.

- Re-enter Password: Re-enter the same password to confirm.

- Confirm Password: Click on 'Confirm Password'.

- Success: Your password is set successfully, and your Axis Direct account is activated.

We hope you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.

Comments ()