Bajaj Finance Card Online Apply

Bajaj Finance offers a variety of cards designed to cater to different financial needs, from shopping and cash withdrawals to EMI facilities. Whether you're looking to manage your expenses better, avail of loans on easy terms, or enjoy discounts and offers, a Bajaj Finance Card can be a valuable addition to your wallet. This guide will take you through the steps to apply for a Bajaj Finance Card, covering eligibility criteria, the application process, and what you can expect once you get your card.

Table of Contents

- Bajaj Finance Card Online Apply

- Bajaj Card Age Limit

- Insta Emi Card Bajaj Finserv Charges

- Bajaj Insta Emi Card Benefits

- How to Block Bajaj Emi Card

- How to Unblock Bajaj Emi Card

- Bajaj Customer Care

How to Apply for a Bajaj Finance Card Online?

Applying for a Bajaj Finance Card online is a quick and straightforward process. Here’s a step-by-step guide to help you through the application:

- Visit the Official Website: Go to the official Bajaj Finance website and navigate to the 'My Account' section.

- Log In: Enter your registered phone number or email ID and authenticate the login using an OTP (One-Time Password) or your password.

- Navigate to the 'Insta EMI Card' Section: Once logged in, go to the 'My Relationship' section and find the 'Insta EMI Card' section.

- Enter Your Mobile Number: Enter your 10-digit mobile number and click on the 'GET IT NOW' button.

- Verify Your Mobile Number: Enter the OTP sent to your registered mobile number and submit.

- Fill in the Application Form: Provide your full name, PAN (Permanent Account Number), date of birth, and PIN code. You can choose to auto-fetch your details if they are already registered with Bajaj Finance.

- Select Your Gender and Employment Type: Choose your gender and employment type, then click on 'PROCEED'.

- Check Your Pre-Qualified Card Loan Offer: Review your pre-qualified card loan offer amount and click on 'PROCEED' to verify your KYC (Know Your Customer) details.

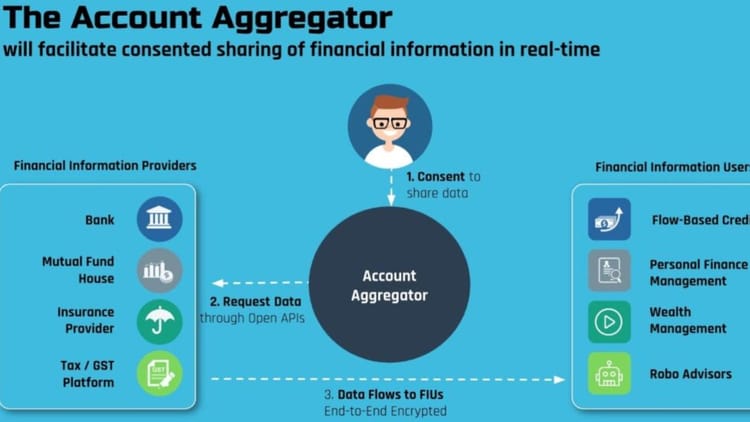

- Complete KYC Verification: Verify your KYC details using your UID/Aadhar card or DigiLocker.

- Apply a Promo Code (Optional): Select and apply a promo code of your choice, if available.

- Pay the One-Time Joining Fee: Pay the one-time joining fee of Rs. 530 (inclusive of applicable taxes).

- View Your Card Details: After successful payment, view your card details on the Bajaj Finance app.

Applying for a Bajaj Finance Card online is designed to be quick and hassle-free. By following these steps, you can get your Insta EMI Card in just a few minutes.

Bajaj Card Age Limit

- The age limit for the Bajaj Finance Insta EMI Card is 21 to 65 years. This ensures that both young adults and those nearing retirement can benefit from its easy financing options.

Insta Emi Card Bajaj Finserv Charges

- Joining Fee: Rs. 530 (inclusive of applicable taxes).

- EMI Network Card Fee: Additional fees may apply when using the EMI Network Card to avail loans.

Bajaj Insta Emi Card Benefits

The Bajaj Finserv Insta EMI Card offers several benefits to make your shopping experience more convenient and affordable:

- Zero Interest: No interest charges on your EMIs.

- Pre-qualified Loan Amount: A pre-qualified card loan offer amount of up to ₹3 lakh.

- Flexible Repayment Tenure: Choose from flexible repayment tenures ranging from 1 to 60 months.

- Wide Acceptance: Accepted at over 1.5 lakh partner stores across more than 4,000 cities.

- Zero Down Payment: Enjoy zero down payment on a wide range of products.

- Special EMI Schemes: Opt for lower-EMI special schemes that offer longer repayment tenures and reduce your monthly EMI.

- End-to-End Digital Process: The entire application process is online and takes less than 10 minutes.

- No Annual Fee: No annual or renewal fee for the Insta EMI Card.

- Easy Access: Access your card details easily through the Bajaj Finserv app.

These benefits make the Insta EMI Card a great option for managing your expenses and making big-ticket purchases more affordable.

How to Block Bajaj Emi Card?

To block your Bajaj Finserv Insta EMI Card, follow these steps:

- Log in to the Bajaj Finserv Customer Portal: Visit the official website and log in using your registered mobile number and OTP.

- Verify Your Details: Enter your date of birth for verification.

- Select Your Insta EMI Card: Go to the 'My Relations' section and select your Insta EMI Card.

- Block the Card: Click on the 'Block Card' option within the 'Quick Actions' section.

- Provide Reasons: Enter the reasons for blocking and proceed.

Once you complete these steps, your Insta EMI Card will be blocked, and you'll receive a notification confirming the change.

How to Unblock Bajaj Emi Card?

To unblock your Bajaj Finserv Insta EMI Card, follow these steps:

- Log in to the Bajaj Finserv Customer Portal: Visit the official website and log in using your registered mobile number and OTP.

- Verify Your Details: Enter your date of birth to verify your identity.

- Select Your Insta EMI Card: Go to the 'My Relations' section and select your Insta EMI Card.

- Unblock the Card: Click on the 'Unblock Card' option within the 'Quick Actions' section.

- Authenticate: Verify your details with an OTP sent to your registered mobile number.

Once you complete these steps, your Insta EMI Card will be unblocked, and you'll receive a notification confirming the change.

Bajaj Customer Care

- If you're having trouble accessing your loan details online, you can contact Bajaj Finance customer care (tel: 086980 10101, +91 8698010101). They will be able to assist you and provide the necessary information.

FAQs:

Can I get a Bajaj Finance card online?

- If you have a steady income and a good CIBIL Score, you can apply for the Bajaj Finserv Insta EMI Card online by clicking on the 'Apply' button at the top of this page. As it is a digital card, you can access it instantly through the 'My Account' section on the Bajaj Finserv customer portal and start enjoying its benefits immediately.

What is the limit of the Bajaj EMI card?

- Experience the unique features and benefits of the Airtel Bajaj Finserv Insta EMI Card. Transform your purchases into Easy EMIs effortlessly. This digital card offers an approved loan limit of up to ₹3 lakhs. It's widely accepted at major shopping platforms and over 1.5 lakh offline stores across 4000+ cities.

How to use a Bajaj EMI card the first time?

- Log in to the customer portal with your registered mobile number and OTP.

- Verify your date of birth.

- Select your Insta EMI Card under 'Your Relations.'

- Click 'Register Now' to complete the e-mandate registration.

What is the age limit for Bajaj Credit Card?

- The eligibility age for the Bajaj Finserv Insta EMI Card is between 21 years and 65 years.

Can an 18-year-old get a Bajaj Finance Card?

To get the Bajaj Finserv Insta EMI Card, you need to meet these simple eligibility criteria:

- Age: Between 21 and 65 years.

- Income: Must have a regular source of income.

If you meet these criteria, you can proceed to apply for the card and enjoy its benefits.

How to unblock blocked Bajaj EMI card?

You can recover your Bajaj Finserv EMI Network Card by visiting the Bajaj Finserv customer portal:

- Log In: Use your registered mobile number and OTP.

- Go to 'Your Relations': Select the EMI Network Card.

- Unblock/Block Card: Click on the 'Unblock Card' option.

Can I deactivate Bajaj Finserv EMI card?

To deactivate or block your Bajaj Finserv Insta EMI Card, follow these steps:

- Log In: Access the Bajaj Finserv service portal using your registered mobile number.

- Navigate to 'Account': Click on 'Account' and go to 'Your Relations.'

- Find Your Insta EMI Card: Locate your Insta EMI Card details.

- Deactivate or Block: Select the option to deactivate or block the card.

- Follow Instructions: Complete the process by following the on-screen instructions.

We hope you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App

Comments ()