Cross-Border Payments:-

What are Cross-Border Payments?

- Cross-border payments refer to transactions where the payer and the recipient are in different countries. These payments are essential for international trade, remittances, and global financial interactions. They can be made using various methods such as bank transfers, credit cards, digital wallets, and other payment services. Cross-border payments are pivotal in facilitating global commerce, enabling businesses to expand beyond domestic borders, and allowing individuals to send money to family and friends abroad.

Why Do Cross-Border Payments Matter?

Cross-border payments are crucial for several reasons:

- Global Trade and Commerce: Businesses rely on cross-border payments to purchase goods and services from international suppliers. Efficient cross-border payment systems are essential for the smooth functioning of global trade.

- Economic Growth: By enabling transactions across borders, these payments contribute to economic growth and development. They open up new markets for businesses and provide consumers with access to a wider range of products and services.

- Remittances: Millions of people work abroad and send money back home to support their families. Cross-border payments ensure these remittances are transferred safely and efficiently.

- Investment and Tourism: Cross-border payments facilitate foreign direct investment (FDI) and tourism, both of which are significant contributors to many countries' economies.

Also Read Our More Articles :-

- Exchange Earner’s Foreign Currency (EEFC) Account, Eligibility, Features and Benefits

- एक्सचेंज अर्नर्स फॉरेन करेंसी (EEFC) अकाउंट, पात्रता, सुविधाएँ और लाभ

- Wise Account : पूर्ण प्रक्रिया, मुख्य सेवाएँ और सुविधाएँ

- क्रॉस-बॉर्डर पेमेंट्स की दुनिया की खोज- प्रकार और उपयोग

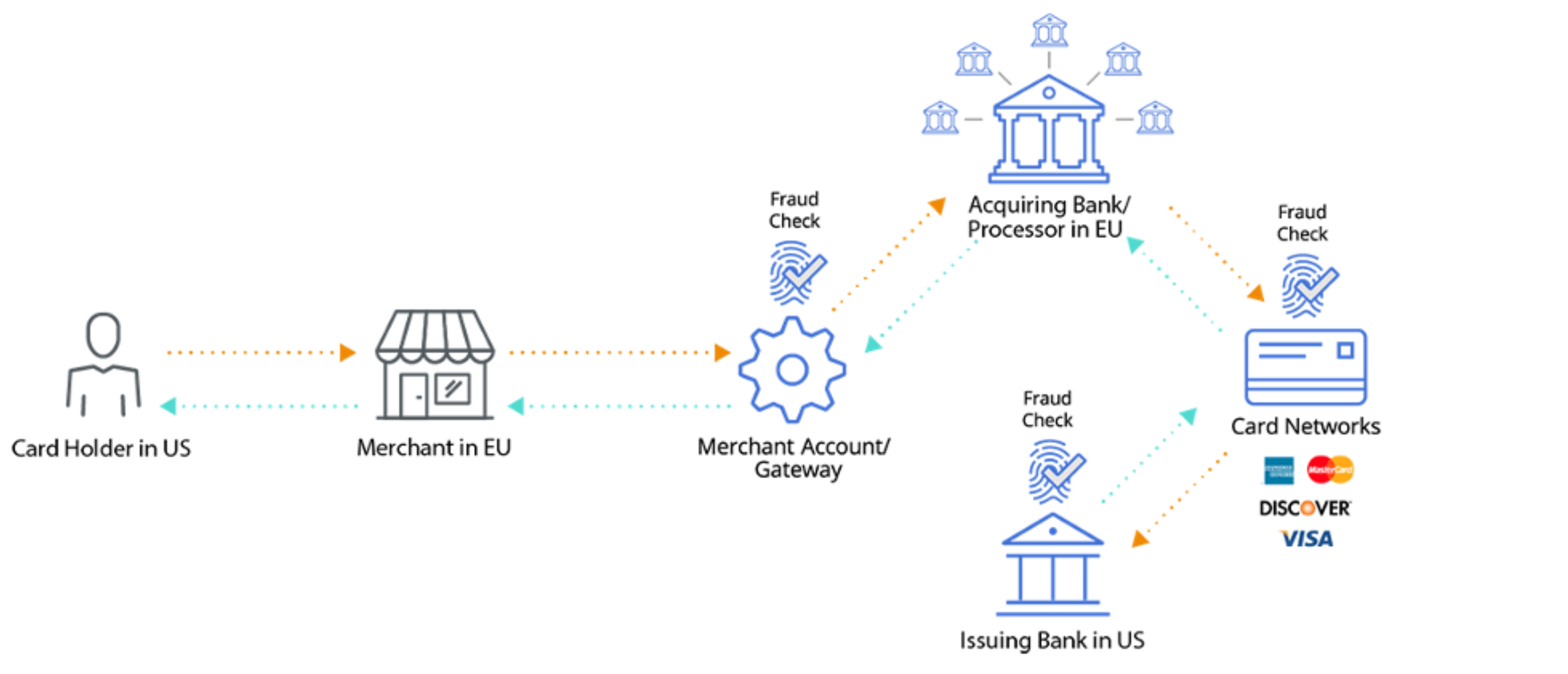

How Do Cross-Border Payments Work?

Cross-border payments typically involve several steps and intermediaries to transfer funds from the sender to the recipient. Here's a simplified explanation of the process:

- Initiation: The payer initiates the payment through a bank, payment service provider, or digital wallet. They provide details such as the amount, currency, and recipient's information.

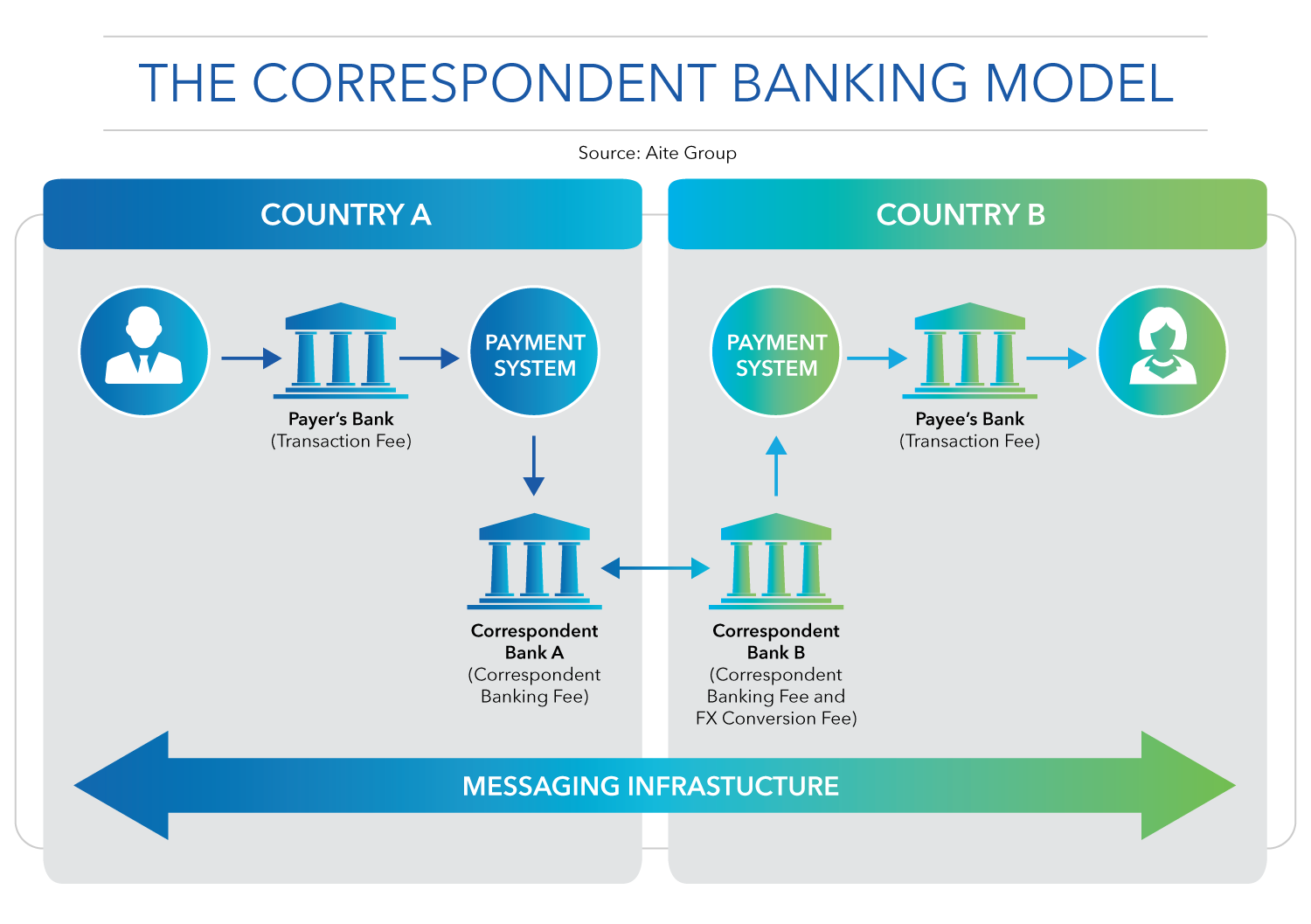

- Intermediary Banks: The payer's bank (originating bank) may not have a direct relationship with the recipient's bank (beneficiary bank). In such cases, intermediary banks (correspondent banks) are used to facilitate the transfer.

- Currency Conversion: If the payment involves different currencies, the funds are converted at the prevailing exchange rate. Currency conversion can add complexity and cost to the transaction.

- Compliance and Verification: Cross-border payments are subject to regulatory checks to prevent money laundering and fraud. Both the originating and beneficiary banks must ensure compliance with international and domestic regulations.

- Settlement: Once all checks are completed, the funds are settled into the recipient's account. Settlement times can vary from a few hours to several days, depending on the payment method and countries involved.

Example Figure: Cross-Border Payment Process

What are the Key Challenges for Cross-Border Payments?

Despite their importance, cross-border payments face several challenges:

- High Costs: Transaction fees, currency conversion charges, and intermediary bank fees can make cross-border payments expensive, especially for small and medium-sized enterprises (SMEs) and individuals.

- Slow Processing Times: Cross-border payments can take several days to process due to the involvement of multiple intermediaries and compliance checks.

- Regulatory Complexity: Different countries have varying regulations for cross-border payments, making it challenging for businesses to navigate the legal landscape.

- Currency Risk: Fluctuations in exchange rates can impact the final amount received by the beneficiary, introducing uncertainty and risk.

- Lack of Transparency: It can be difficult for payers and recipients to track the status of their payments, leading to uncertainty and potential disputes.

Other Details:

Innovations and Solutions:

To address these challenges, several innovations and solutions are being developed:

- Blockchain and Distributed Ledger Technology (DLT): Blockchain can streamline cross-border payments by reducing the need for intermediaries, enhancing transparency, and speeding up settlement times.

- Fintech Solutions: Financial technology (fintech) companies are offering innovative payment solutions that reduce costs and improve efficiency. Examples include TransferWise (now Wise), PayPal, and Revolut.

- ISO 20022: This international standard for electronic data interchange between financial institutions aims to improve the quality and efficiency of cross-border payments by standardizing messaging formats.

- Central Bank Digital Currencies (CBDCs): Some countries are exploring CBDCs to facilitate faster and cheaper cross-border payments. CBDCs could reduce reliance on correspondent banks and simplify currency conversion.

Impact of COVID-19:

- The COVID-19 pandemic has accelerated the adoption of digital payment solutions and highlighted the need for efficient cross-border payment systems. As businesses and individuals increasingly rely on digital channels for transactions, the demand for seamless and cost-effective cross-border payments has grown.

Also Read Our More Articles :-

- Exchange Earner’s Foreign Currency (EEFC) Account, Eligibility, Features and Benefits

- एक्सचेंज अर्नर्स फॉरेन करेंसी (EEFC) अकाउंट, पात्रता, सुविधाएँ और लाभ

- Wise Account : पूर्ण प्रक्रिया, मुख्य सेवाएँ और सुविधाएँ

- क्रॉस-बॉर्डर पेमेंट्स की दुनिया की खोज- प्रकार और उपयोग

Conclusion:

- Cross-border payments are a critical component of the global economy, enabling international trade, remittances, and financial interactions. Despite the challenges of high costs, slow processing times, regulatory complexity, and currency risk, innovations in technology and regulatory frameworks are paving the way for more efficient and transparent cross-border payment systems. As the world becomes increasingly interconnected, the importance of reliable and efficient cross-border payments will continue to grow.

FAQs:

What are cross-border payments?

- Cross-border payments are transactions where the payer and the recipient are in different countries. They are essential for international trade, remittances, and global financial interactions.

Why are cross-border payments important?

- Cross-border payments facilitate global trade, contribute to economic growth, enable remittances, and support investment and tourism.

What are cross-border payment terms?

- Cross-border payments are transactions between different countries. They involve transfer fees, bank fees, currency conversion rates, exchange fees, and international credit card fees. These factors make cross-border transactions more complex and potentially costly.

How do cross-border payments work?

- Cross-border payments involve several steps, including initiation by the payer, involvement of intermediary banks, currency conversion, compliance checks, and settlement into the recipient's account.

What are the main challenges of cross-border payments?

- The main challenges include high costs, slow processing times, regulatory complexity, currency risk, and lack of transparency.

How are innovations addressing cross-border payment challenges:

- Innovations are addressing cross-border payment challenges by introducing blockchain technology, digital currencies, and real-time payment systems. These advancements reduce costs, increase transaction speeds, and enhance transparency and security, making international transactions more efficient and accessible for businesses and individuals.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App