Difference Between Gold Bar vs Gold Coin & Gold Jewellery

- Gold has been a symbol of wealth, status, and investment for centuries. When it comes to investing in gold, two primary options often considered are gold jewellery and gold bars or coins. While both have their own advantages and unique attributes, they serve different purposes and cater to different needs. This article aims to provide a comprehensive comparison between gold jewellery and gold bars or coins, detailing their differences in various aspects such as investment, liquidity, purity, and cultural significance.

Introduction to Gold Jewellery and Gold Bars & Coins:

- Gold Jewellery: Gold jewellery is not only an investment but also a form of adornment. It is crafted into various forms such as necklaces, rings, bracelets, and earrings. The craftsmanship, design, and cultural significance add to its value, making it a popular choice, especially in countries like India where gold jewellery is often associated with cultural and traditional ceremonies.

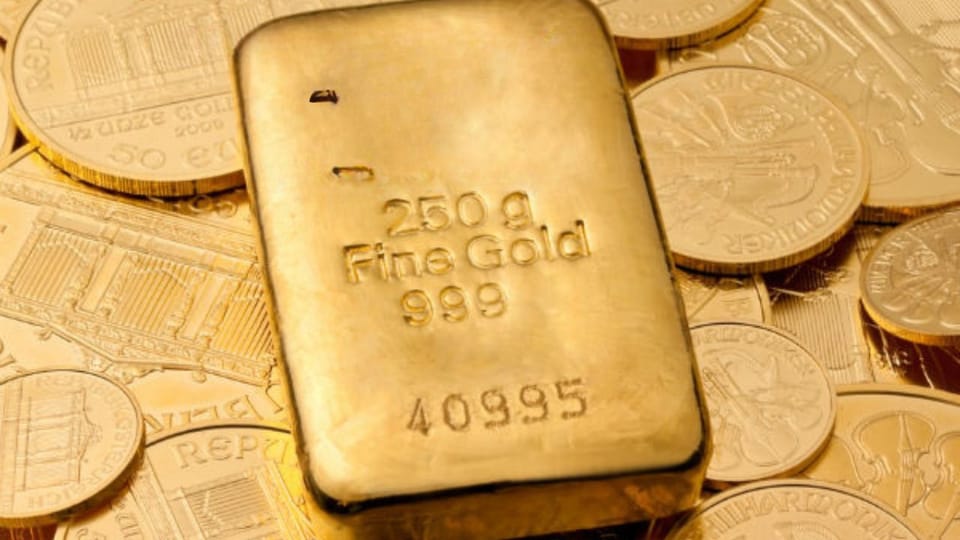

- Gold Bars & Coins: Gold bars and coins are primarily used for investment purposes. They are available in various weights and are valued purely for their gold content. Unlike jewellery, bars and coins do not carry additional costs associated with craftsmanship and design, making them a straightforward investment in terms of purity and weight.

Key Differences Between Gold Jewellery and Gold Bars & Coins:

1. Purpose and Usage:

Gold Jewellery:

- Adornment: Primarily used as adornment and a symbol of status and wealth.

- Cultural Significance: Plays a significant role in cultural and traditional ceremonies, especially in countries like India and China.

- Gifting: Commonly given as gifts during weddings, festivals, and other significant occasions.

Gold Bars & Coins:

- Investment: Primarily used for investment purposes due to their high purity and standardized weight.

- Savings: Often used as a form of savings to hedge against inflation and currency fluctuations.

- Liquidity: Easier to sell in the market compared to jewellery, which may require additional verification of purity and craftsmanship.

2. Purity and Value:

Gold Jewellery:

- Purity: Typically ranges from 14K to 22K, with 22K being the most common for high-quality jewellery. The purity is often compromised due to the addition of other metals to enhance durability.

- Value: Includes the cost of gold, making charges, and sometimes even brand premiums. The resale value is often lower due to depreciation of making charges.

Gold Bars & Coins:

- Purity: Generally available in 24K purity, which is 99.9% pure gold. Some coins may have 22K purity.

- Value: Purely based on the weight and current market price of gold. There are minimal additional costs, making it a more straightforward investment.

3. Making Charges and Premiums:

Gold Jewellery:

- Making Charges: Includes additional making charges which can range from 5% to 20% of the gold value, depending on the complexity of the design and craftsmanship.

- Brand Premiums: Some jewellery brands charge premiums for their designs and craftsmanship.

Gold Bars & Coins:

- Minimal Premiums: There are minimal making charges or premiums involved, making them a cost-effective investment.

- Standardized Pricing: Prices are more standardized and closely linked to the market rate of gold.

4. Liquidity and Ease of Selling:

Gold Jewellery:

- Verification Required: Selling gold jewellery often requires verification of purity and assessment of making charges. The resale value can be affected by the design and brand.

- Depreciation: May face depreciation in value due to wear and tear over time.

Gold Bars & Coins:

- High Liquidity: Easier to sell due to standardized purity and weight. They can be quickly converted to cash at market rates.

- No Depreciation: Maintains value as long as the gold purity and weight remain unchanged.

5. Storage and Security:

Gold Jewellery:

- Storage: Requires careful storage to avoid damage and theft. Often stored in lockers or safes.

- Insurance: May require insurance to protect against theft or loss, adding to the overall cost.

Gold Bars & Coins:

- Easier Storage: Compact and easy to store in a safe or bank locker.

- Lower Risk: Lower risk of theft compared to jewellery, as they can be stored in smaller spaces.

6. Emotional and Sentimental Value:

Gold Jewellery:

- Sentimental Value: Often carries emotional and sentimental value, especially when passed down through generations.

- Cultural Importance: Holds significant cultural and traditional importance, especially in weddings and festivals.

Gold Bars & Coins:

- Investment Focused: Primarily considered an investment and does not carry the same sentimental value as jewellery.

- No Cultural Significance: Generally does not play a role in cultural or traditional practices.

Comparison Table: Gold Jewellery vs Gold Bars & Coins

| Aspect | Gold Jewellery | Gold Bars & Coins |

|---|---|---|

| Primary Purpose | Adornment, cultural significance | Investment, savings |

| Purity | 14K to 22K | 22K to 24K (99.9% pure) |

| Value | Gold value + making charges | Based on gold weight and purity |

| Making Charges | 5% to 20% of gold value | Minimal or none |

| Brand Premiums | Applicable | Not applicable |

| Liquidity | Verification required, lower resale value | High liquidity, easy to sell |

| Storage | Requires careful storage, insurance | Compact, easy to store |

| Sentimental Value | High, often passed down generations | Low, primarily investment-focused |

| Cultural Importance | Significant in weddings and festivals | No cultural significance |

Conclusion:

- Both gold jewellery and gold bars or coins have their own unique advantages and serve different purposes. Gold jewellery is an excellent choice for those who value the cultural and emotional significance of gold, along with its use as adornment. On the other hand, gold bars and coins are ideal for investors looking for a straightforward and cost-effective way to invest in gold with high liquidity and minimal additional costs.

- When deciding between the two, it is essential to consider your primary purpose—whether it is for adornment and cultural reasons or for investment and savings. Understanding these differences can help you make a more informed decision and ensure that your investment in gold aligns with your financial goals and personal preferences.

FAQs:

What is the main difference between gold jewellery and gold Bars/coins?

- Gold jewellery is primarily used for adornment and cultural significance, while gold bars and coins are mainly for investment purposes. Jewellery includes making charges and brand premiums, whereas bars and coins have minimal additional costs.

Are gold jewellery good as an investment?

- Gold jewellery can be a good investment, but their resale value is often lower due to making charges and depreciation. Gold bars and coins are more straightforward and liquid investments.

What is the importance of purity in gold bars and coins?

- Gold bars and coins are typically 22K or 24K (99.9% pure), meaning their value is based on purity and weight. Investors prefer them due to their high purity.

Are gold bars and coins more liquid than jewellery?

- Yes, gold bars and coins are more liquid as they can be easily sold at market rates. Selling jewellery requires verification of purity and making charges, making the process more complex.

How should gold jewellery and gold bars/coins be stored?

- Gold jewellery should be stored carefully to avoid damage or theft, often in lockers or safes, and may require insurance. Gold bars and coins are more compact and can be easily stored in a safe or bank locker.

Do gold jewellery have emotional and cultural value?

- Yes, gold jewellery often has emotional and cultural significance, especially when passed down through generations. They play an important role in weddings, festivals, and other significant occasions.

Are gold bars and coins more investment-focused than jewellery?

- Yes, gold bars and coins are primarily considered investments and do not carry the same emotional or cultural significance as jewellery. They are preferred by investors for their high purity and liquidity.

How is the purity of gold jewellery determined?

- The purity of gold jewellery is typically measured in carats, with 14K to 22K being common. 22K is more common for high-quality jewellery, but other metals are added for durability.

What are the benefits of investing in gold bars and coins?

- The benefits of investing in gold bars and coins include high purity, minimal additional costs, high liquidity, and easy storage. They maintain their value without depreciation.

Is the resale value of gold jewellery lower than that of bars and coins?

- Yes, the resale value of gold jewellery is generally lower due to making charges and depreciation. The resale value of gold bars and coins is based on purity and weight, making them more beneficial.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App

Comments ()