How Can I Book Locker in the Axis Bank App?

India's second largest Private sector bank i.e. Axis Bank has developed an App for Smartphones. With the help of this App Axis Bank customers can book a Bank locker anywhere in India by sitting a home. Initially to book the locker in the bank you have to visit the desired Axis Bank branch and ask for the availability. If the locker is available you can book the locker by doing the bank formality. It is a very long and time-consuming process. To get rid of such a time-consuming process Axis Bank has developed an App for Booking a Bank Locker in Any Axis Bank Branch in India.

Table of Content

- Book Locker via Axis Mobile App

- Axis Bank Locker Charges

- Locker Booking Terms & Conditions

- Recharge & Pay Bills Online With Axis Bank App

- Recharge & Pay Bills Online With Axis Bank Internet Banking

- Axis Bank Credit Card Bill Payment via App

- Axis Bank Credit Card Bill Payment via Internet Banking

- Axis Bank Credit Card Bill Payment via ATM

Step-by-Step Process to Book Locker Through App

- Open Axis Bank Mobile App - Launch the Axis Bank mobile app on your smartphone.

- Log in to Your Account - Enter your login credentials to access your Axis Bank account.

- Navigate to Services or Locker Booking Section—Look for a section in the app menu related to services or locker booking. The labeling of this section may vary, so explore options related to banking services.

- Select Locker Booking - Once you find the appropriate section, look for an option like "Locker Booking" or "Safe Deposit Locker." Tap on it to initiate the booking process.

- Choose Preferred Branch - Select the Axis Bank branch where you wish to book the locker. Some apps may provide information about the availability of lockers in different branches.

- Select Locker Size and Type - Choose the size and type of locker based on your preferences and requirements. Different lockers may have varying rental charges and sizes.

- Provide Required Details—Please fill in the necessary details, such as your name, contact information, and any other information required during the booking process.

- Submit Application - After entering the required information, submit your locker booking application through the app.

- Verification and Approval - The bank will review your application, and once approved, you may receive a confirmation message. This process may take some time, and the bank may contact you for additional verification if needed.

- Visit the Branch for Documentation - After approval, visit the selected Axis Bank branch to complete any necessary documentation and formalities related to locker booking.

Axis Bank Locker Charges

- At present, Axis Bank has 944 branches across India. The Locker Annual rent depends upon the locker's size and the branch's location. There are four categories depending on the locker size: small, Medium, large, and Extra-large.

| Location | Locker Size | Rentals starting from* (applicable GST extra) |

|---|---|---|

| Rural | Small | 1500 |

| Medium | 2200 | |

| Large | 5000 | |

| X-Large | 10000 | |

| Semi-urban | Small | 1700 |

| Medium | 2500 | |

| Large | 5500 | |

| X-Large | 11000 | |

| Metro/Urban | Small | 3105 |

| Medium | 6900 | |

| Large | 11800 | |

| X-Large | 14256 |

Rentals may vary between branches in the same location. Please check applicable rentals via Internet/Mobile banking or by visiting the branch. Revised Locker Rent effective 1 April 2022.

Terms & Conditions

- Locker rent is charged annually and is collected in advance. Our locker rentals vary based on locker size and branch location.

- Late payment penalty @2.5% per month up to a maximum of 25% will be applicable.

- Discounts, if applicable, will be offered only on maintenance of relationship value as per customer product category.

- One-time Locker registration charge: Rs.1000 + GST (Not applicable for Burgundy / Burgundy Private customers).

- The number of free locker visits – is 3 per calendar month, post which Rs.100 + GST is applicable per visit (Not applicable for Burgundy / Burgundy Private customers).

- Click here for Standard Operating Procedure.

- Click here for applicable stamp duty for executing the locker agreement.

Recharge & Pay Bills Online With Axis Bank

In today's fast-paced world, handling your finances seamlessly is essential. Axis Bank, one of India's leading banks, offers easy and efficient ways to manage your bill payments and recharges through its mobile app and internet banking. Here's how you can make the most of these services.

Using the Axis Bank Mobile App

Axis Bank's mobile app is designed to provide users with a hassle-free experience. Here’s a step-by-step guide to recharging and paying bills using the app:

Step-by-Step Guide

- Download and Log In: Ensure you have the Axis Bank app installed on your smartphone. Open the app and log in using your credentials.

- Navigate to 'Bill Pay & Recharge': On the home screen, select the 'Bill Pay & Recharge' option.

- Choose the Service: Select the type of service you want to pay for or recharge, such as mobile, DTH, electricity, gas, or water.

- Enter Details: Fill in the required details such as your mobile number, customer ID, or bill number, depending on the service chosen.

- Select Payment Method: Choose your preferred payment method (debit card, credit card, or bank account).

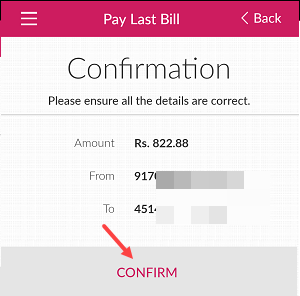

- Confirm and Pay: Review the details and confirm the payment. You will receive a confirmation message upon successful completion.

Features and Benefits

- Instant Payment: Transactions are processed instantly, ensuring timely payments and recharges.

- User-Friendly Interface: The app is designed to be intuitive and easy to navigate.

- Secure Transactions: Axis Bank employs robust security measures to protect your financial data.

Using Axis Bank Internet Banking

If you prefer using a computer, Axis Bank's Internet banking platform is an excellent alternative for managing your bills and recharges. Here's how to do it:

- Log In: Visit the Axis Bank internet banking website and log in using your User ID and password.

- Go to 'Payments': Navigate to the 'Payments' section on the dashboard.

- Select 'Bill Pay & Recharge': Choose the 'Bill Pay & Recharge' option from the dropdown menu.

- Choose the Service: Select the service category (mobile, DTH, electricity, etc.).

- Enter Details: Provide the necessary details such as mobile number, bill number, or customer ID.

- Choose Payment Method: Select your payment method and enter the payment details.

- Confirm and Pay: Review the entered details and confirm the payment. You will receive an acknowledgment once the transaction is complete.

Features and Benefits

- Convenience: Pay bills and recharge from the comfort of your home.

- Transaction History: Keep track of all your past transactions easily.

- Multiple Payment Options: Choose from various payment methods to suit your preference.

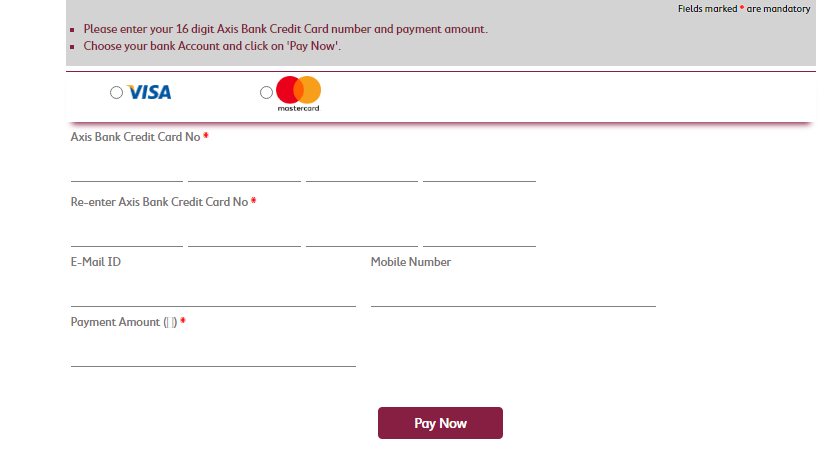

Axis Bank Credit Card Bill Payment

Paying your Axis Bank credit card bill is a hassle-free process with multiple options to suit your convenience. Timely payments ensure you maintain a good credit score and avoid late fees.

Here’s a detailed guide on how to make your Axis Bank credit card payment through various channels.

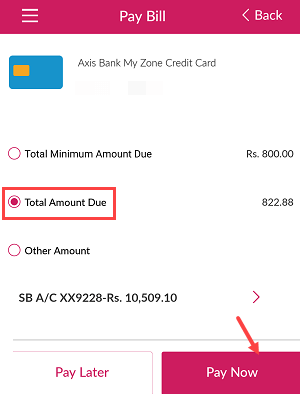

Axis Bank Mobile App

The Axis Bank Mobile App is a quick and efficient way to pay your credit card bill:

- Download and Log In: Make sure you have the Axis Bank app installed on your smartphone. Open the app and log in using your credentials.

- Go to Credit Card Section: Navigate to the ‘Credit Cards’ section on the app.

- Select Your Credit Card: Choose the credit card for which you want to make the payment.

- Select Payment Option: Choose your preferred payment method (savings account, debit card, or net banking).

- Enter Payment Details: Enter the amount you wish to pay and confirm the payment.

- Receive Confirmation: You will receive a confirmation message upon successful completion of the payment.

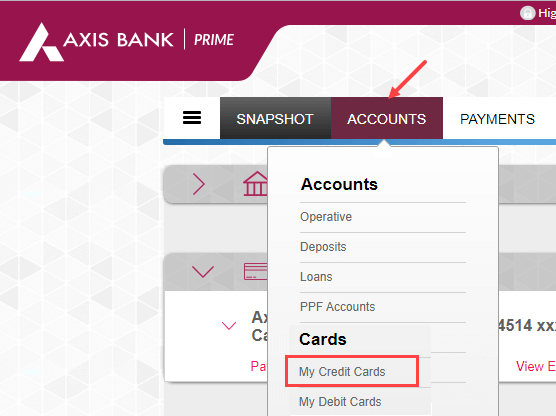

Axis Bank Internet Banking

If you prefer using a computer, Axis Bank’s internet banking platform offers a seamless way to pay your credit card bill:

- Log In: Visit the Axis Bank internet banking website and log in using your User ID and password.

- Go to Payments: Navigate to the ‘Payments’ section on the dashboard.

- Select Credit Card Payment: Choose the ‘Credit Card Payment’ option from the dropdown menu.

- Enter Payment Details: Provide the necessary details such as credit card number and the amount to be paid.

- Choose Payment Method: Select your payment method and enter the payment details.

- Confirm and Pay: Review the entered details and confirm the payment. You will receive an acknowledgment once the transaction is complete.

Axis Bank ATM

You can also pay your credit card bill through any Axis Bank ATM:

- Insert Your Debit Card: Visit the nearest Axis Bank ATM and insert your debit card.

- Enter PIN: Input your PIN to access the ATM services.

- Select Credit Card Payment: Choose the ‘Credit Card Payment’ option from the menu.

- Enter Credit Card Details: Provide your credit card number and the amount to be paid.

- Confirm and Pay: Confirm the payment. A receipt will be generated for your records.

Auto-Debit Facility

For a more convenient and automated option, you can set up the Auto-Debit facility:

- Log In: Visit the Axis Bank internet banking website and log in using your credentials.

- Go to Services: Navigate to the ‘Services’ section.

- Select Auto-Debit Setup: Choose the ‘Auto-Debit’ option for credit card payments.

- Enter Details: Provide your credit card number, account number, and the date on which you want the payment to be debited.

- Confirm Setup: Confirm the setup. Your credit card bill will be automatically debited on the chosen date every month.

NEFT/IMPS

You can also use NEFT/IMPS to pay your credit card bill from any other bank account:

- Log In to Your Bank’s Net Banking: Access your bank’s net banking portal.

- Add Beneficiary: Add your Axis Bank credit card as a beneficiary. Use the card number as the payee account number and IFSC code UTIB0000001.

- Initiate Payment: Enter the amount and other details to initiate the payment.

- Confirm and Pay: Confirm the transaction. The payment will be credited to your Axis Bank credit card account.

FAQs

How to book a locker in Axis Bank online?

- Sign in to Axis Bank Internet Banking.

- Click 'Apply Now' and select 'Book Locker'.

- Choose the branch and check locker availability.

What is the cost of a locker in Axis Bank?

| Location | Small (Rs.) | Medium (Rs.) | Large (Rs.) | X-Large (Rs.) |

|---|---|---|---|---|

| Rural | 1500 | 2200 | 5000 | 10000 |

| Semi-urban | 1700 | 2500 | 5500 | 11000 |

| Metro/Urban | 3105 | 6900 | 11800 | 14256 |

Who is eligible to apply for lockers in Axis Bank?

- Opening a Safe Deposit Locker might require specific documents. Current Axis Bank account holders can visit their nearest branch for assistance. No additional documentation is needed for existing account holders.

Is the locker charge monthly or yearly?

- Rentals may vary between branches within the same location.

- Locker rent is charged annually and collected in advance.

Can we keep gold in a bank locker?

- Bank lockers are an excellent choice for safeguarding gold and other valuables due to the high-security measures implemented by financial institutions. These include advanced surveillance systems, restricted access, and secure vault construction deep within the building to prevent theft and external threats. This innovative infrastructure ensures maximum security for your assets.

How to recharge FASTag in Axis Bank?

- Log in to your internet banking or mobile banking app.

- Add your vehicle as a beneficiary with FASTag wallet ID or vehicle number.

- Enter your bank's IFSC code (For Axis Bank, it's UTIB0000ETC).

How to pay the electricity bill online through Axis Bank?

- Log in to Axis Internet Banking.

- Go to Payments > Pay Bills.

- Add New Biller (if not already added).

- Select the Electricity Biller and click pay bill.

- Enter the details and amount, then click proceed.

- Enter the OTP and confirm the payment.

How to recharge your Axis Bank prepaid card online?

- Log onto www.axisbank.com.

- Select the Prepaid Card option under Internet Banking.

- Use the 16-digit Axis Bank Gift Card number as Login ID.

- Use the Internet Banking PIN as a Password.

How can I pay my Axis Bank credit bill?

To pay your Axis Bank credit card bill:

- Log in to the Axis Bank Mobile App or Internet Banking.

- Go to Payments and select 'Credit Card Payment'.

- Enter Details like credit card number and amount.

- Confirm Payment and complete the transaction.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.

Comments ()