How to Activate Paytm Postpaid?

Paytm Postpaid kaise Activate Karein?

- Activating Paytm Postpaid is a straightforward process that allows you to enjoy the convenience of credit for your online and offline purchases. Paytm Postpaid is a popular service that offers users the flexibility to shop now and pay later, making it an attractive option for those who want to manage their expenses effectively. With a credit limit assigned to you, you can use it for a variety of transactions, including shopping on the Paytm app, paying bills, and more.

- To get started, you first need to download the Paytm app and log in to your account. If you are a new user, you will need to register and complete the KYC (Know Your Customer) process. Once logged in, navigate to the Postpaid section in the app. Here, you will find an option to activate your Paytm Postpaid account. Simply follow the on-screen instructions, which may involve a quick verification process.

- Once activated, you can enjoy the benefits of instant credit and repay the amount at your convenience within the billing cycle. This feature not only enhances your shopping experience but also helps you build a good credit score when used responsibly. In this article, we will guide you through the steps to activate Paytm Postpaid seamlessly.

How to Get Paytm Postpaid?

- Install the Paytm App: If you haven't already, download and install the Paytm app on your smartphone. You can find it on the Google Play Store for Android devices or the Apple App Store for iOS devices.

- Login or Sign Up: Open the Paytm app and log in with your existing Paytm account credentials. If you don't have an account, you'll need to sign up by providing your mobile number and creating a password.

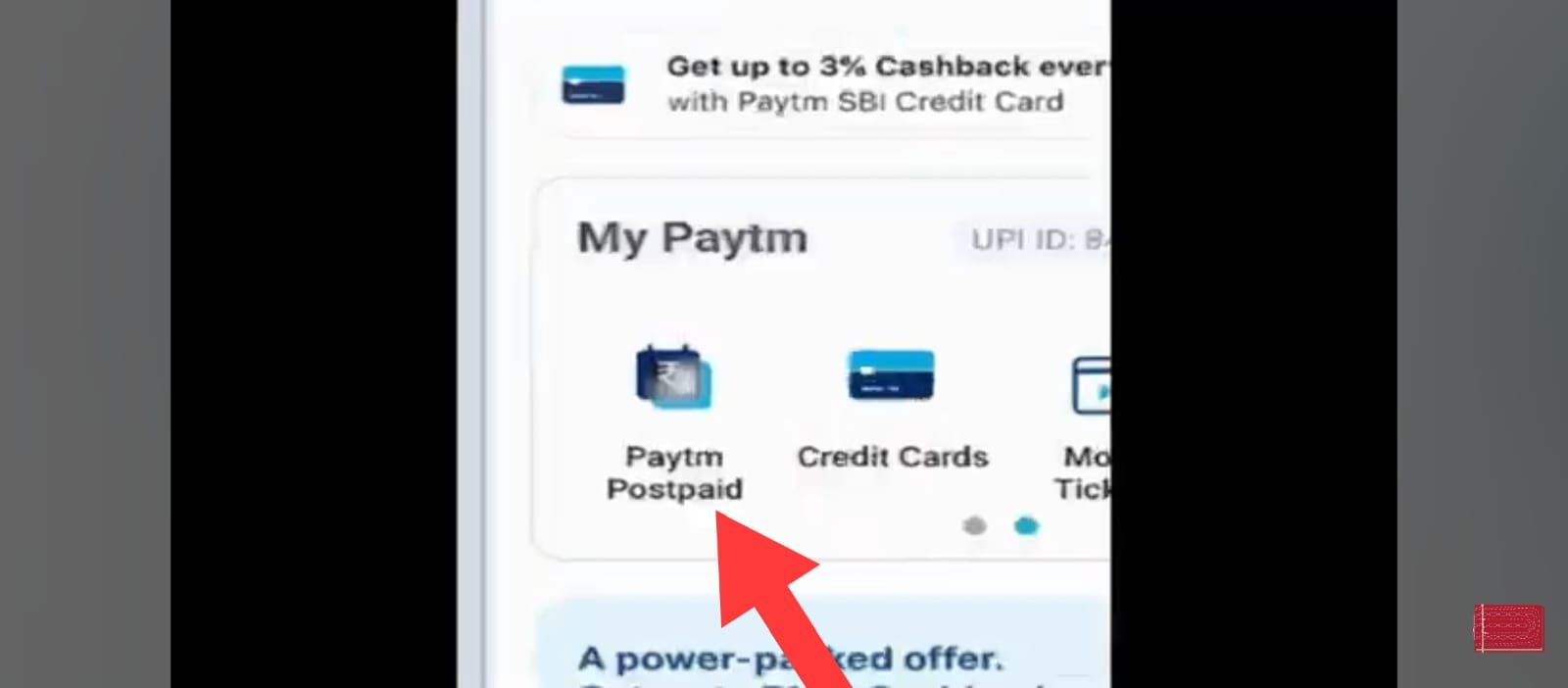

- Navigate to Paytm Postpaid: Once logged in, look for the "Postpaid" section within the Paytm app. This section might be accessible from the home screen or the main menu. Paytm Postpaid is typically found in the Financial Services or Wallet section.

- Complete the KYC (Know Your Customer): To activate Paytm Postpaid, you may need to complete the KYC process if you haven't done so already. This involves providing certain documents for identity verification. Follow the on-screen instructions to complete the KYC process.

- Check Eligibility: Paytm Postpaid has eligibility criteria based on your transaction history and other factors. Check if you meet the eligibility requirements to activate Paytm Postpaid.

- Activate Paytm Postpaid: If you are eligible, you should see an option to activate Paytm Postpaid. Click on the activation button and follow the prompts to complete the activation process.

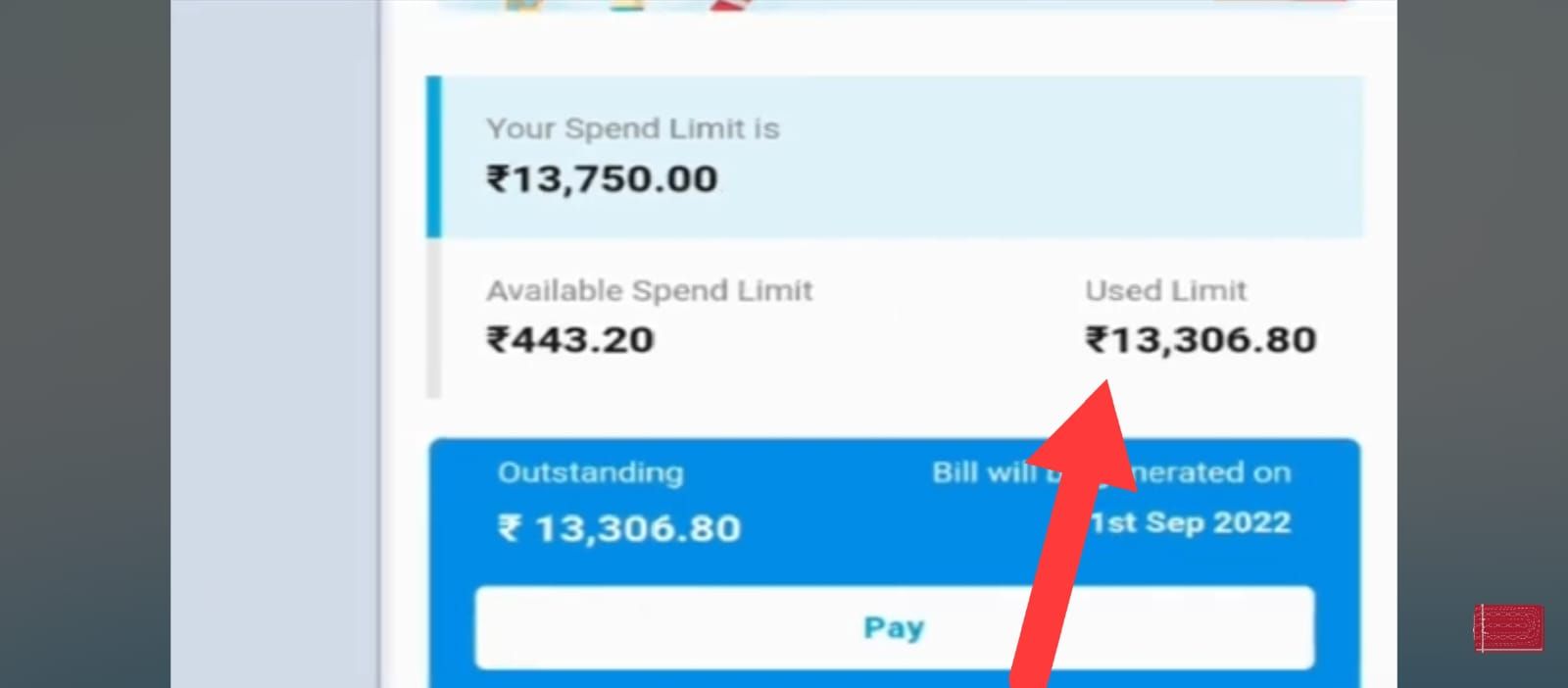

- Credit Limit: After activation, Paytm will assign a credit limit based on your eligibility. This credit limit will determine the maximum amount you can spend using Paytm Postpaid.

- Start Using Paytm Postpaid: Once activated, you can start using Paytm Postpaid for various transactions within the specified credit limit.

FAQs:

How can I activate my Paytm Postpaid limit?

- After providing all the information and completing the digital KYC process, you need to review the offer and accept the t&c. Paytm postpaid services will be activated immediately, and you can check your credit limit under the “accounts tab."

Can I withdraw money from Paytm Postpaid?

- Paytm postpaid limit is not for withdraw. It can be used for paying bills for specific merchant accounts. You can find all the details there.

What is the penalty for Paytm postpaid?

- After the due date, late payment charges will be applicable, in the range of Rs 5-600 per month, depending on the outstanding. For instance, if you have an outstanding of Rs 1,000 and you don't repay by the 7th of the month, you will have to pay a late payment charge of Rs100 per month, which would be 10% of the due amount

How can I transfer money from Paytm postpaid to wallet?

Withdraw money from Paytm postpaid to a wallet

- Open the Paytm Application.

- Scan the QR code of the Paytm merchant account.

- enter the amount.

- transfer money to the Paytm merchant account.

- Now, from the business Paytm account, you can conveniently transfer money to Paytm wallet.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.

Comments ()