How to Apply Bajaj E-Mandate Online?

What is E-Mandate in Bajaj Finserv?

- An E-Mandate in Bajaj Finserv is an electronic authorization that allows automatic payment of EMIs (Equated Monthly Installments) from your bank account. This process ensures that your loan payments are made on time without manual intervention. Once you set up an E-Mandate, the specified amount is automatically deducted from your account on the due date, helping you avoid late fees and maintain a good credit score.

Step-by-Step Guide to Registering Your E-Mandate:

Select your Insta EMI Card from the 'My Relations' section for which you want to register the mandate. Click on 'Register Now' and proceed with mandate registration. Enter your bank details, IFSC, and other details, and complete your e-mandate.

E-Mandate Registration Process

We can provide you with a general idea of the steps involved in setting up an e-mandate, which is a digital authorization for automatic payments:

- Visit the Official Website: Go to the official website of Bajaj Finserv. Ensure that you are on the official and secure website to protect your personal information.

- Log In or Register: If you already have an account with Bajaj Finserv, log in using your credentials. If you don't have an account, you may need to register.

- Navigate to the EMI Card section: Once logged in, find the section related to your EMI Card. It may be labeled as "EMI Card," "My EMI Card," or similar.

- Navigate to the E-Mandate Section: Look for the e-mandate section on the website. This could be under the account settings, payments, or a similar section.

- Authorize the e-mandate: To complete the registration process, you may need to authorize the e-mandate by providing consent. This consent may include accepting the terms and conditions associated with the e-mandate service.

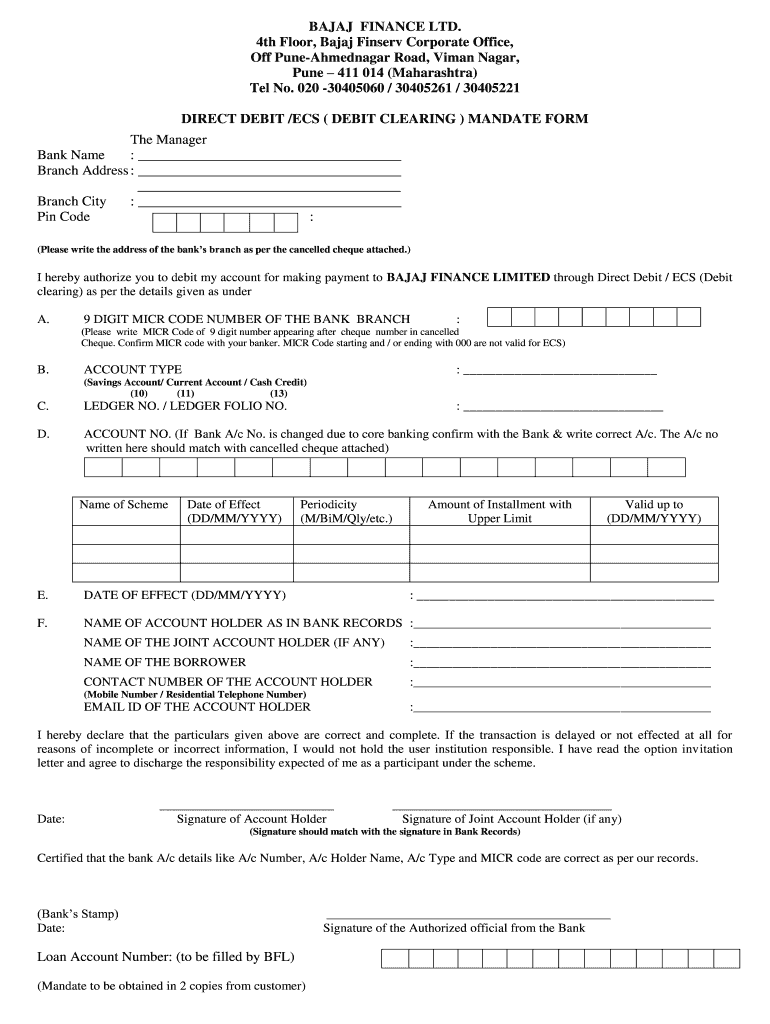

- Fill in Mandate Details: Provide the necessary details for setting up the e-mandate. This may include your bank account details, the amount to be deducted, the registering frequency of deductions, and other relevant information.

- Authentication: Bajaj Finserv may require you to authenticate the e-mandate. This could be done through a one-time password (OTP) sent to your registered mobile number or any other method of verification.

- Review and Confirm: Review the details you have entered and confirm the e-mandate setup.

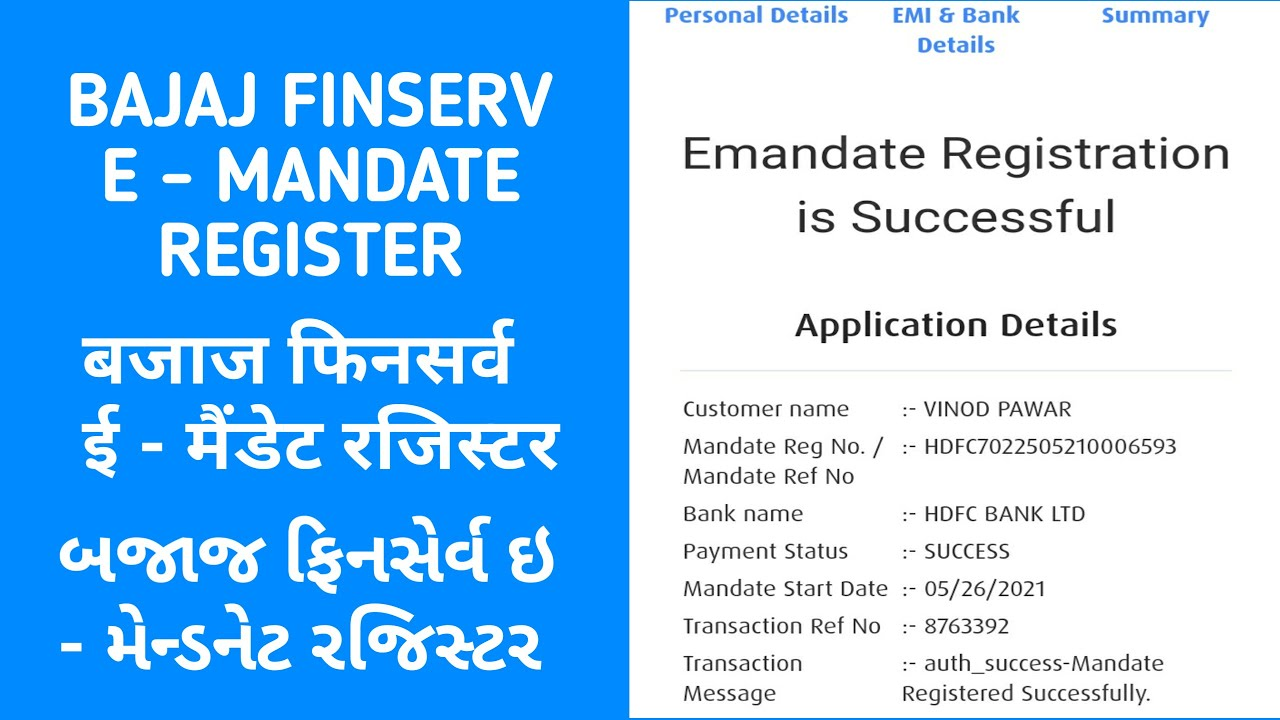

- Confirmation and activation: After successful validation, you should receive a confirmation message stating that your e-mandate registration is complete. The e-mandate service should now be activated on your Bajaj EMI Card.

- Check Bank Statement: Keep an eye on your bank statements to ensure that the automatic deductions are taking place as per the e-mandate.

FAQs:

What is the e-mandate on Bajaj Finserv?

- E-mandate enables automatic EMI deductions directly from your bank account, ensuring that your payments are made on time and helping you avoid late fees.

What are e-mandate charges?

- What is the fee charged to the Cardholder? There is no fee charged to the Cardholder. The E-Mandate facility is provided free of cost to the customer.

How do I check if my e-mandate is active?

- You can check your e-mandates by logging into the Internet banking portal or mobile banking app of your respective bank. If you wish to cancel the e-mandate, you can do so at any time by contacting the merchant. The NPCI serves as a mediator to resolve any issues or disputes that may arise between the parties involved.

How do I register for an e-mandate?

- To register for an E-Mandate in Bajaj Finserv, log in to the Bajaj Finserv customer portal or mobile app. Select your loan account, choose the E-Mandate option, and provide your bank details. Authenticate the process using OTP or net banking credentials. Once confirmed, the E-Mandate will be set up for automatic EMI payments.

What is the e-mandate maximum amount?

- The maximum amount for an E-Mandate is Rs 1,00,000 per transaction, as per RBI guidelines. This limit primarily applies to specific categories like subscriptions to mutual funds, payment of insurance premiums, and credit card bill payments. For other transactions, the limit may vary, so it's essential to check with your service provider for precise details.

What is an e-mandate in banking?

- An e-mandate in banking is an electronic authorization that allows customers to automate recurring payments directly from their bank accounts. It enables the bank to debit a specified amount on a predetermined schedule, such as for loan EMIs, utility bills, or subscriptions, without the need for manual intervention. This process ensures timely payments and helps avoid late fees or service disruptions.

Is an E-mandate safe?

- Yes, an E-Mandate is safe. It is regulated by the Reserve Bank of India (RBI) and involves multiple layers of security, such as encryption, two-factor authentication (like OTP), and customer consent. These measures ensure that your bank account is protected, and only authorized transactions are processed, making the process secure and reliable for recurring payments.

What is the minimum balance for E-mandate registration?

- The minimum amount for an E-Mandate is Rs 5,000, and the maximum is Rs 1 crore. These limits are set to ensure that transactions fall within a specific range, accommodating both small and large payments. Always ensure that the amount set in your mandate is within this range to avoid any issues during the transaction process.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App

Comments ()