How to Apply for a Cheque Book in Axis Bank?

To apply for a chequebook in Axis Bank, you have several convenient options. You can request it through the Axis Bank Mobile App, internet banking, by visiting a branch, or even via SMS. The process is simple and can be done in a few steps. Once your request is processed, the chequebook will be delivered to your registered address. This service makes it easy to manage your banking needs efficiently.

- Axis Bank Chequebook Request Online

- Axis Bank FD Apply Online Process via Internet Banking

- Axis Bank FD Apply Online Process via Mobile Banking

- Axis Bank FD Apply Online Process via Branch

- Axis FD Interest Rates

- Axis Bank FD Benefits

Axis Bank Chequebook Request Online

- Download and Install the Axis Bank App: Ensure that you have the Axis Bank mobile banking app installed on your smartphone. You can download it from the official app store relevant to your device (Google Play Store for Android or Apple App Store for iOS).

- Login to Your Account: Open the Axis Bank app and log in using your internet banking credentials, Such as username & password. If you don't have an account, you may need to register for internet banking through the app.

- Navigate to the Services or Requests Section: Once logged in, look for a section within the app that is dedicated to services or requests. The exact location of this section may vary, but it's typically found in the main menu or dashboard.

- Select "Cheque Book Request": Look for an option related to chequebook requests. It might be labeled as "Order Cheque Book," "Cheque Book Request," or something similar. Select that option.

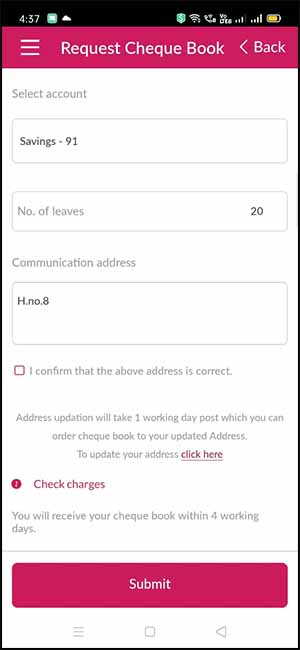

- Choose Account and Number of Leaves: You may need to choose the bank account for which you want the cheque book. Additionally, you might be asked to specify the number of leaves (cheques) you want in the cheque book. Follow the on-screen instructions to provide this information.

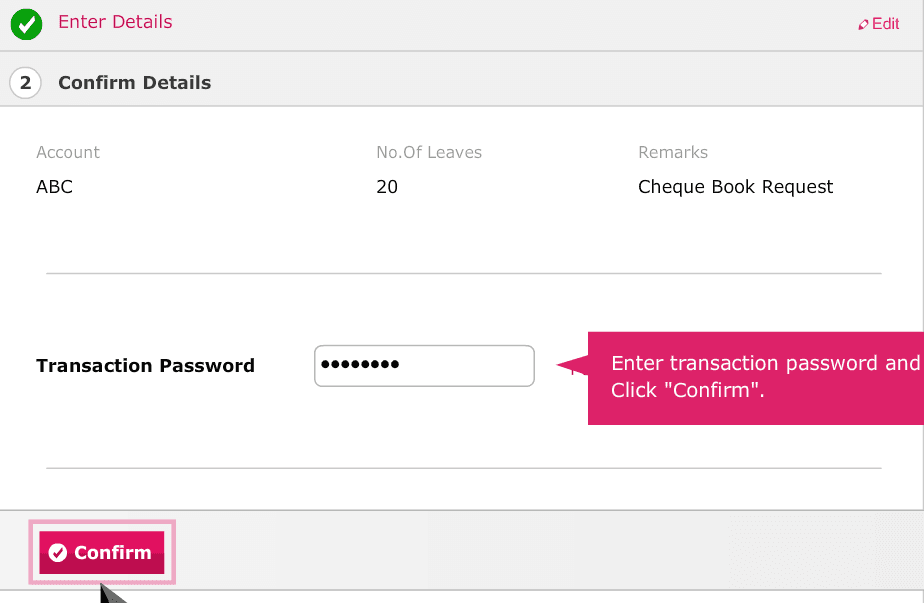

- Verify and Confirm: Review the details you've entered to ensure accuracy. Some apps may provide a summary of your request before finalizing. If everything is correct, proceed to confirm your chequebook request.

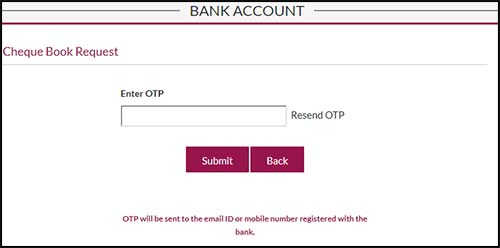

- Authentication: You may need to authenticate the request using a One-Time Password (OTP) sent to your registered mobile number.

- Confirmation Message: After successful submission, you should receive a confirmation message on the app, and you might also get an email or SMS confirming your chequebook request.

- Wait for Delivery: The bank will process your request, and the chequebook will be dispatched to your registered address. The time taken for delivery may vary.

Axis Bank FD Apply Online Process

Investing in a Fixed Deposit (FD) with Axis Bank offers a secure and reliable way to grow your savings. Here's a step-by-step guide to applying for an Axis Bank FD online.

Steps to Apply for FD Online via Internet Banking:

- Login: Start by logging into your Axis Bank Internet Banking account using your User ID and Password.

- Navigate: Once logged in, navigate to the 'Deposits' section from the main menu.

- Create FD: Select the option to 'Create Fixed Deposit' from the list of available services.

- Details: Enter the required details such as the amount you wish to deposit, tenure, and nomination details.

- Review: Review the details to ensure all information is correct.

- Confirm: Click on the 'Confirm' button. The deposit amount will be debited from your linked Savings Account.

- Receipt: You will receive an instant web receipt acknowledging your deposit.

- FD Advice: The FD advice will be sent to your registered email address or physical address based on your e-statement preferences.

Steps to Apply for FD Online via Mobile Banking:

- Login: Open the Axis Bank Mobile Banking app and log in with your credentials.

- Select FD: Choose the option to 'Open Fixed Deposit' from the menu.

- Enter Details: Provide the necessary details including deposit amount, tenure, and nominee information.

- Confirm: After reviewing the details, click 'Confirm'. The deposit amount will be deducted from your Savings Account.

- Receipt: An instant web receipt will be generated.

- FD Advice: The FD advice will be emailed or physically mailed to you.

Branch Visit:

- Visit: Visit your nearest Axis Bank branch.

- Assist: Request assistance from a bank representative to guide you through the FD application process.

- Documents: Submit the necessary documents and details for the FD.

- Acknowledgment: Receive an acknowledgment receipt and the FD advice will be sent to your registered address.

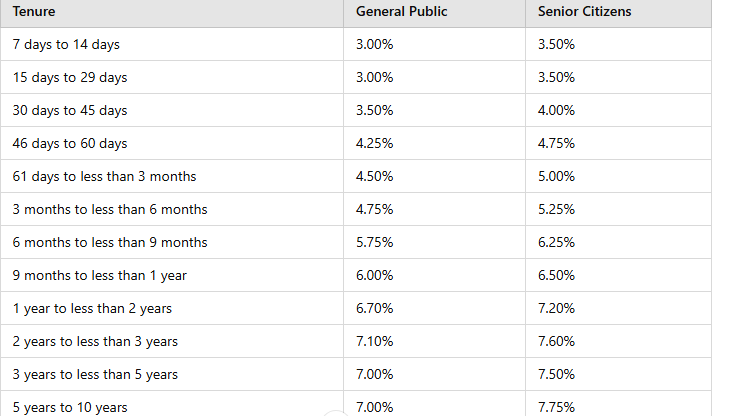

Axis FD Interest Rates

Axis Bank offers attractive interest rates for Fixed Deposits. The rates vary based on the tenure and customer category. Here are the current interest rates:

Note: Senior citizens receive an additional interest rate benefit, typically 0.50% to 0.75% higher than the general public rates.

Axis Bank FD Benefits

- Guaranteed Returns: Fixed Deposits offer secure and predictable returns on your investment.

- Higher Interest Rates: FDs generally offer higher interest rates compared to regular Savings Accounts.

- Tax Benefits: Certain FDs provide tax benefits under Section 80C of the Income Tax Act.

- Flexibility: Axis Bank FDs come with a variety of tenure options to suit your financial goals.

- Loan Against FD: You can avail of a loan against your FD without breaking the deposit.

- Ease of Access: Applying for an FD online is a quick and hassle-free process.

FAQs:

How can I get a cheque book from Axis Bank immediately?

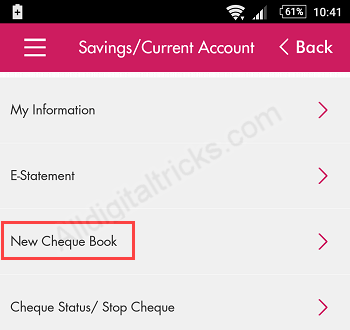

- Open the Axis Bank app.

- Log in with your credentials.

- Go to Services and Support.

- Select Savings/Current Account.

- Tap New Cheque Book.

- Confirm your request.

How to request a cheque book in Axis Bank?

- Login to the Axis Bank app.

- Navigate to Services.

- Select Cheque Book Request.

- Enter your details and confirm the request.

What is the FD rate in Axis Bank?

- Axis Bank offers Fixed Deposits with interest rates ranging from 6.75% to 7.75%, depending on the scheme and tenure. For senior citizens, the bank provides an additional 0.65% interest, bringing their rates up from 7.4% to 8.4%. This is higher compared to the general public, who receive rates between 3% and 7.10%.

How to check FD in Axis Bank?

To download FD/RD advice via Axis Bank Internet Banking:

- Login to Internet Banking.

- Go to Accounts > Deposits.

- Select your FD.

- Click on FD/RD Advice.

- The advice will be downloaded in PDF format.

What is the FD rate of Axis Bank?

| Term | Interest Rate (General) | Interest Rate (Senior Citizens) |

|---|---|---|

| 1 year to less than 15 months | 6.70% | 7.20% |

| 15 months to less than 18 months | 7.25% | 7.75% |

| 18 months to less than 2 years | 7.25% | 7.75% |

| 2 years to less than 3 years | 7.10% | 7.60% |

| 3 years to less than 5 years | 7.10% | 7.60% |

| 5 years to 10 years | 7.00% | 7.75% |

Is Axis Bank FD good?

- Axis Bank Fixed Deposits (FDs) provide a secure way to grow your savings, with flexible tenures from 7 days to 10 years and a minimum deposit starting at ₹5,000. Enjoy competitive interest rates tailored to your financial goals.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.

Comments ()