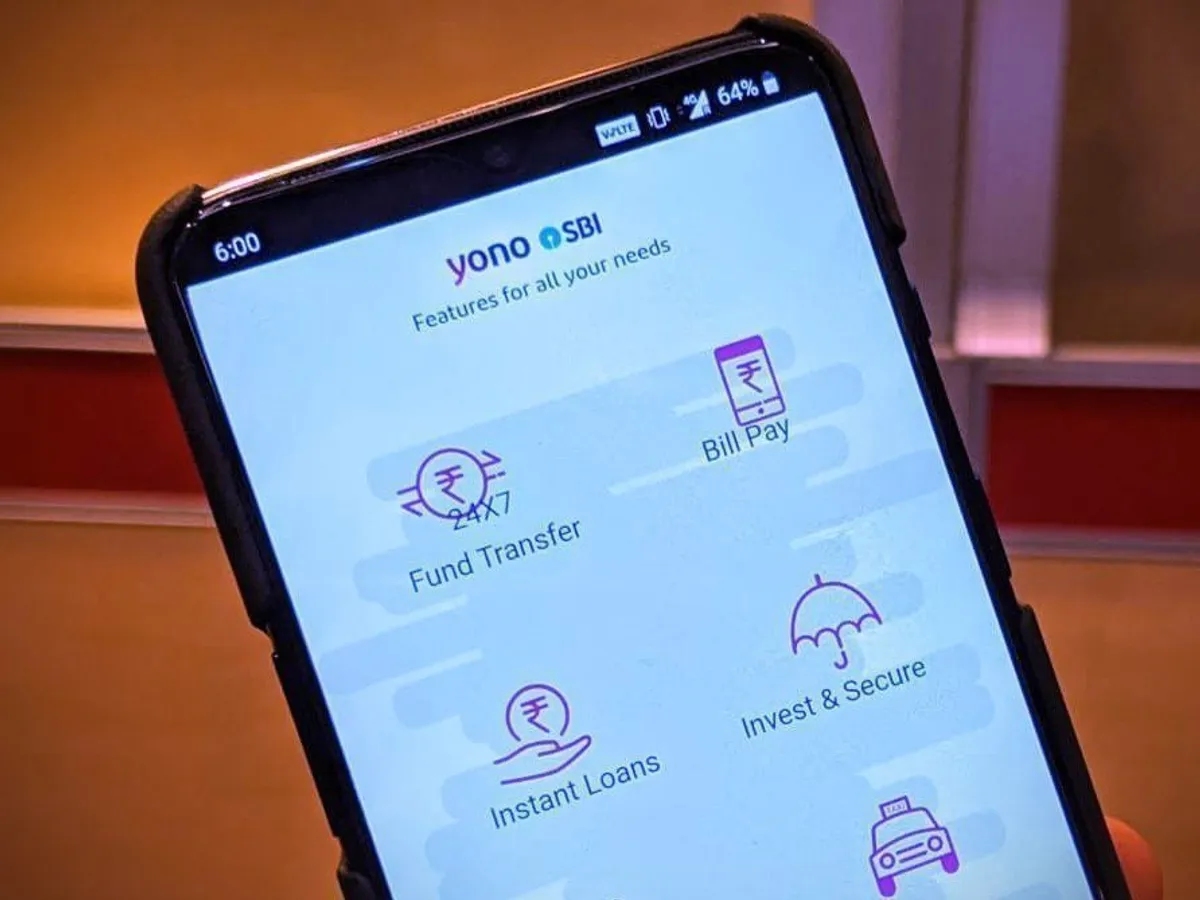

- State Bank of India (SBI) has launched YONO (You Only Need One) app to make digital banking more accessible. Through this app, customers can avail a variety of banking services, including applying for personal loans. Applying for a personal loan through the YONO SBI app is extremely simple and convenient. In this article, we will tell you in detail how you can apply for a personal loan using the YONO SBI app, and will also answer important questions related to it.

Download and Install YONO SBI App:

- Ensure you have the YONO SBI app installed on your smartphone. You can download it from the App Store (for iOS devices) or Google Play Store (for Android devices).

Registration/Login:

- If you're not already a user, you'll need to register on the app. For existing users, log in using your credentials.

Navigate to 'Loans' Section:

- Once logged in, navigate to the 'Loans' section. This may be located in the main menu or on the home screen, depending on the app's layout.

Choose 'Personal Loan':

- Look for the option that specifically mentions "Personal Loan" or similar. Select that option.

Check Eligibility:

- The app will typically prompt you to check your eligibility for a personal loan. This involves entering relevant information such as your income, employment details, and other personal details.

Submit Required Documents:

- After checking your eligibility, you may be required to submit necessary documents. These documents might include proof of identity, address, income, and other relevant information.

Loan Amount and Terms:

- Specify the loan amount you're looking for and the repayment terms. The app may provide you with options based on your eligibility.

Review and Submit:

- Review all the details you've provided and ensure they are accurate. Submit the application.

Approval Process:

- After submitting your application, the bank will review it. This may involve a credit check and an assessment of your financial status.

Loan Disbursement:

- If your application is approved, the loan amount will be disbursed to your linked bank account.

Repayment:

- Ensure you are aware of the repayment schedule and make timely payments.

FAQs:

Can I apply for a personal loan through the YONO app if my account is not with SBI?

- No, to apply for a personal loan through the YONO app, you must have an account with SBI. This feature is available only for SBI account holders.

What is the processing time for a personal loan through the YONO app?

- If you have a pre-approved offer, the loan processing and disbursement time is very short, often within a few hours. In other cases, the process may take 1-2 working days.

How can I check my SBI YONO loan eligibility?

Eligibility Criteria for YONO App Personal Loan

For CSP (Customer Service Point) Customers:

- Must be an active SBI savings bank account holder.

- The account should be linked to YONO App.

For Non-CSP Customers:

- Active SBI savings bank account with good transaction history.

- Account must be linked to the YONO App.

For Savings Bank Account Holders:

- Eligible account holders can check their personal loan eligibility by sending an SMS.

- SMS format: 'PAPL####' (where #### are the last 4 digits of the account number) to 567676.

How do I activate my YONO personal loan?

- How to Avail a Personal Loan via YONO App

- Login to YONO.

- Click on the PAPL banner.

- Input your PAN and Date of Birth.

- Select the loan amount, tenure, and EMI payment date.

- Accept the Terms & Conditions.

- Enter OTP to confirm, and the loan amount will be credited to your Savings Bank Account.

What is the minimum loan amount in YONO?

- Purpose:

- Government and defense personnel with a salary account at State Bank of India can apply for the SBI Real Time Xpress Credit Personal Loan online via the SBI YONO app, offering instant loan disbursal.

- Loan Amount:

- Minimum Loan Amount: Rs. 25,000

What is the tenure for a personal loan through the YONO app?

- You can take a personal loan through the YONO app for a tenure ranging from 12 months to 60 months.

Is a guarantor required for a personal loan through the YONO app?

- In most cases, a guarantor is not required for a personal loan through the YONO app. However, this may vary depending on the bank’s terms and conditions.

Can I track the personal loan applied for through the YONO app online?

- Yes, you can track the status of your personal loan application directly within the YONO app.

If my personal loan application is rejected, can I apply again?

- If your application is rejected, you can analyze the reasons for the rejection, make the necessary improvements, and then apply again.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App