How to Check Debit Card Transaction Limit in the SBI YONO App?

To check your SBI withdrawal limit in the SBI YONO app, follow a simple process that allows you to manage your card settings efficiently. The SBI YONO app provides a convenient platform for customers to monitor and control their debit card usage, including setting daily transaction limits for various types of transactions such as ATM withdrawals, POS transactions, and online purchases. By checking and adjusting these limits through the app, you can ensure your card usage aligns with your financial needs and enhances the security of your transactions.

Table of Content

- YONO Cash Withdrawal Limit

- SBI Personal Loan Apply Online

- SBI Personal Loan Rate of Interest

- SBI Personal Loan Eligibility

- SBI Personal Loan Customer Care Number

- SBI Personal Loan Emi Calculator

- Important FAQs

YONO Cash Withdrawal Limit

- Open the YONO SBI App: Go to your mobile device and open the YONO SBI App. Make sure you have logged in using your credentials.

- Navigate to the Debit Card Section: You will find a menu or options bar once logged in. Look for the option related to debit cards or banking services. Click on it to proceed.

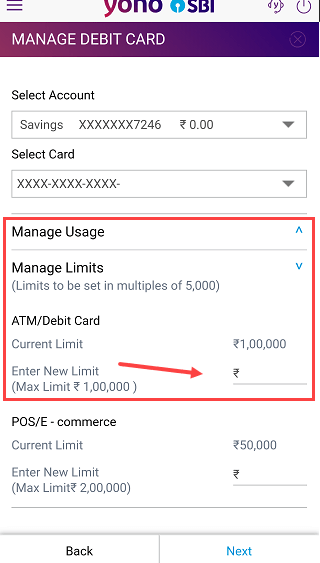

- Select Your Debit Card: If you have multiple debit cards linked to your account, choose the one you want to check the transaction limit.

- Check the Transaction Limit: After selecting the specific debit card, you should see an option to view the transaction limits associated with it. The app may display both daily and monthly limits for various types of transactions such as ATM withdrawals, online transactions, and point-of-sale (POS) transactions.

- Review the Details: Take note of the transaction limits and ensure they meet your requirements. If you need to make any changes to the limits, some banks provide an option to customize the limits based on your preferences. You may be able to do this directly through the app.

- Update or Modify Limits (if needed): If you find that the transaction limits are not suitable for your needs, some banks allow you to modify these limits through the app itself. Look for an option that allows you to change or customize the limits as per your requirements.

- Save Changes (if applicable): If you have modified the transaction limits, make sure to save the changes by following the instructions provided in the app.

https://youtu.be/L0g3m9GSd9k?si=-xQD-xzX_klljuhl

SBI Personal Loan Apply Online

State Bank of India (SBI) offers a seamless and efficient way to apply for personal loans online. Whether you need funds for a medical emergency, home renovation, or any other personal expense, SBI's loans are designed to meet your financial needs with ease.

Why Choose SBI Personal Loans?

- Low Interest Rates: Enjoy competitive interest rates that make borrowing affordable.

- Minimal Documentation: Apply with minimal paperwork, making the process hassle-free.

- No Prepayment Penalties: Reduce your interest burden by prepaying your loan without any penalties.

- Flexible Loan Tenure: Choose a repayment tenure that suits your financial situation.

- 24/7 Customer Support: Access to dedicated support for any queries or assistance.

How to Apply via Internet Banking

- Visit the SBI Website: Go to the official SBI website and navigate to the personal loans section.

- Log In: Use your internet banking credentials to log in to your account.

- Select Loan Type: Choose the personal loan option that best suits your needs.

- Fill in Details: Provide the necessary information, including your personal details, income, and loan amount.

- Submit Application: Review the details and submit your application.

- Approval and Disbursement: Once approved, the loan amount will be disbursed to your account.

How to Apply via the YONO App

- Download the YONO App: If you haven't already, download the YONO app from the Google Play Store or Apple App Store.

- Log In: Open the app and log in using your SBI internet banking credentials or YONO app username and password.

- Navigate to the Loans Section: Tap on the "Loans" option in the main menu.

- Select Personal Loan: Choose the "Personal Loan" option from the list of available loan types.

- Fill in the Details: Enter the necessary information such as your details, income, and desired loan amount.

- Review and Submit: Review all the details to ensure they are correct and then submit your application.

- Receive OTP: You will receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to confirm your application.

- Approval and Disbursement: Once approved, the loan amount will be disbursed directly to your SBI account.

Benefits of Applying via the YONO App

- Ease of Access: Apply from anywhere, anytime.

- Quick Processing: Faster approval and disbursement process.

- User-Friendly Interface: Simple and intuitive application process.

- Track Application: Easily track the status of your loan application within the app.

https://youtu.be/jeJPj6CDQbM?si=H6CPDW-zmMtvF5Cl

SBI Personal Loan Rate of Interest

- Sbi Personal Loan Start From 11.45% p.a.*

Xpress Credit Scheme

- Defence/ Indian Coast Guard/ Central Armed Police: 11.45% - 12.95% per annum

- Central Govt./ State Govt./ Police/ Railway/ Central Public Sector Enterprises (CPSEs): 11.60% - 14.10% per annum

- Other Corporates: 12.60% - 14.60% per annum

Xpress Elite Scheme

- Salary Account with SBI: 11.45% - 11.95% per annum

- Salary Account with another bank: 11.40% - 11.90% per annum

Pension Loan Schemes

- SBI Pension Loan: 11.30% per annum

- Pre-Approved Insta Pension Top-Up Loan: 11.30% per annum

- Pre-Approved Pension Loan (PAPNL): 11.30% per annum

- Pension Loan Scheme for Treasury & PSU Pensioners: 11.30% - 11.80% per annum

- Jai Jawan Pension Loan: 11.30% per annum

General Personal Loan

- Interest Rate: 11.15% - 14.30% per annum

- Minimum Loan Amount: ₹25,000

- Maximum Loan Amount: Up to ₹30 lakh (24 times Net Monthly Income)

SBI Personal Loan Eligibility

- Account: Individuals with Salary Account with SBI.

- Age: The applicant must be at least 21 years old and not more than 60 years old at the time of loan maturity.

- Income: The minimum monthly income requirement is ₹25,000.

- Employment: The applicant must be employed with a minimum service period of 1 year in the current job.

- CIBIL Score: A minimum CIBIL score of 750 is required.

- EMI/NMI Ratio: The EMI/NMI (Equated Monthly Installment/Net Monthly Income) ratio must be less than 60%.

- Residential Status: The applicant must be a resident of India.

- SBI Term Loans Amount

- Minimum Loan Amount: ₹1 lakh

- Maximum Loan Amount: ₹30 lakhs or 24 times Net Monthly Income (NMI)

To check your eligibility for an SBI Quick Personal Loan, simply SMS:

- “PAPL <last 4 digits of your SBI Savings Bank Account No.>” Send it to 567676.

SBI Personal Loan Customer Care Number

- Call: Dial 1800-11-2211 for more information or to apply through the Contact Centre.

- Missed Call: Give a missed call on 7208933142 to receive a Callback.

- SMS: Send an SMS with the word "PERSONAL" to 7208933145 to get a call back from the Contact Centre.

SBI Personal Loan Emi Calculator

You can use the SBI Personal Loan EMI Calculator to estimate your Equated Monthly Installment (EMI). Here's how you can access it:

- Visit the SBI Website: Go to the official SBI website.

- Navigate to the EMI Calculator: Look for the EMI calculator under the personal loans section.

- Enter Loan Details: Input the loan amount, interest rate, and loan tenure.

- Calculate EMI: The calculator will provide you with the estimated EMI based on the details provided.

FAQs:

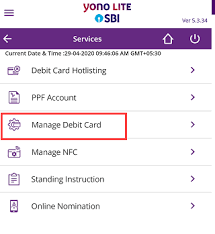

How do I check my SBI debit card online transaction limit?

- To check your SBI debit card online transaction limit, log in to the SBI YONO app or SBI Internet Banking. Navigate to "Debit Card Services," then select "Manage Debit Card." Here, you can view and adjust your online transaction limits as per your requirements.

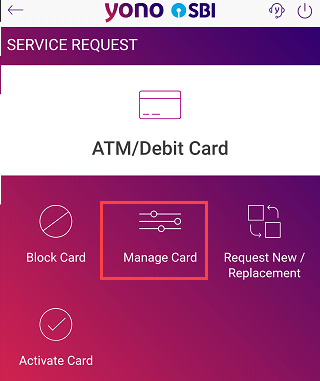

How to change the debit card limit in Yono SBI?

- To change your debit card limit in the SBI YONO app, log in and go to "Service Request." Select "Debit Card Services," then choose "Manage Debit Card." From there, you can adjust your transaction limits for ATM, POS, and online transactions as per your preference. Confirm to apply changes.

How do I check my debit card transaction limit?

- Finding the daily limit on a debit card requires a bit more effort compared to credit cards, where limits are easily accessible on bank statements, online, or via mobile apps. To check your debit card limit, you can call your bank, visit a branch, or review your account disclosure or agreement.

How to set transaction limits in the SBI Yono app?

To set a transaction limit in the SBI YONO app, follow these steps:

- Log in to the SBI YONO app using your credentials.

- Navigate to "Service Request" and select "Debit Card Services."

- Choose "Manage Debit Card."

- Select your card and set your preferred transaction limits for ATM withdrawals, POS transactions, and online purchases.

- Confirm the changes to apply the new limits.

What is the interest rate of an SBI YONO loan?

- Interest Rate: Starts from 11.45% - 14.60% p.a. *

- Maximum Loan Amount: ₹30 lakh

Can I apply for a personal loan through the YONO app if my account is not with SBI?

- No, to apply for a personal loan through the YONO app, you must have an account with SBI. This feature is available only for SBI account holders.

What is the processing time for a personal loan through the YONO app?

- If you have a pre-approved offer, the loan processing and disbursement time is very short, often within a few hours. In other cases, the process may take 1-2 working days.

How can I check my SBI YONO loan eligibility?

Eligibility Criteria for YONO App Personal Loan

For CSP (Customer Service Point) Customers:

- Must be an active SBI savings bank account holder.

- The account should be linked to the YONO App.

For Non-CSP Customers:

- Active SBI savings bank account with a good transaction history.

- The account must be linked to the YONO App.

For Savings Bank Account Holders:

- Eligible account holders can check their personal loan eligibility by sending an SMS.

- SMS format: 'PAPL####' (where #### are the last 4 digits of the account number) to 567676.

How do I activate my YONO personal loan?

- How to Avail a Personal Loan via the YONO App

- Login to YONO.

- Click on the PAPL banner.

- Input your PAN and Date of Birth.

- Select the loan amount, tenure, and EMI payment date.

- Accept the Terms & Conditions.

- Enter OTP to confirm, and the loan amount will be credited to your Savings Bank Account.

What is the minimum loan amount in YONO?

- Government and defense personnel with a salary account at the State Bank of India can apply for the SBI Real-Time Xpress Credit Personal Loan online via the SBI YONO app, offering instant loan disbursal.

- Loan Amount: Minimum Loan Amount: Rs. 25,000

What is the tenure for a personal loan through the YONO app?

- You can take a personal loan through the YONO app for a tenure ranging from 12 months to 60 months.

Is a guarantor required for a personal loan through the YONO app?

- In most cases, a guarantor is not required for a personal loan through the YONO app. However, this may vary depending on the bank’s terms and conditions.

Can I track the personal loan applied for through the YONO app online?

- Yes, you can track the status of your personal loan application directly within the YONO app.

If my loan application is rejected, can I apply again?

- If your application is rejected, you can analyze the reasons for the rejection, make the necessary improvements, and then apply again.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.

Comments ()