How to Check Your Bajaj Loan Statement?

Managing your loan effectively requires staying updated with your loan statements and EMI details. Bajaj Finance provides a convenient way to check your loan statement and EMI details through their online portal and mobile app. Here’s a step-by-step guide to help you access your Bajaj loan statement:

Table of Content

- Check Bajaj Loan Statement

- Check Bajaj Loan Emi Statement Using the Mobile App

- Benefits of Regularly Checking Your Loan Statement

- Foreclosure letter format

- Bajaj Finserv Loan Foreclosure Online

- Benefits of Loan Foreclosure

- How to Pay Bajaj Emi Online?

- Benefits of Online EMI Payment

- Bajaj Customer Care

Check Bajaj Loan Statement Details:

- Log in to the Bajaj Finance Portal: Visit the Bajaj Finance customer portal and log in using your registered mobile number and OTP. Verify your details with your date of birth and proceed.

- Navigate to 'My Account': Once logged in, select the "My Account" section. This section contains all your loan-related information.

- Select Your Loan Account: Choose the loan account for which you want to check the statement from the "My Relations" section.

- View Statements: Click on the "Statements" option within the "Quick Actions" section. Here, you can view and download your loan statement.

- Download Statement: Click on "Statement of Account" to download your loan statement. This document will provide details such as your next EMI due date, principal outstanding, total EMIs paid, and more.

Check Bajaj Loan Emi Statement Using the Mobile App

- Download the Bajaj Finance App: Install the Bajaj Finance app from the App Store or Play Store on your smartphone.

- Log in: Use your registered mobile number and OTP to log in to the app.

- Select Your Loan Account: Choose the loan account for which you want to check the statement.

- View Statements: Tap on the "Statements" option to view and download your loan statement.

Benefits of Regularly Checking Your Loan Statement

- Stay Updated: Regularly checking your loan statement helps you stay informed about your loan balance, repayment schedule, and upcoming EMIs.

- Financial Planning: Knowing your loan details allows you to plan your finances better and avoid any surprises.

- Track Payments: You can track your payments, including principal and interest, to ensure everything is on track.

- Avoid Penalties: By keeping an eye on your EMI due dates, you can avoid late payment penalties and maintain a good credit score.

Tips for a Smooth Experience

- Keep Your Details Updated: Ensure that your registered email and mobile number are up to date to receive timely notifications and updates.

- Use PDF Reader: If your statement is in PDF format, use a PDF reader app to open and view it easily.

- Contact Customer Support: If you encounter any issues or need further assistance, don’t hesitate to reach out to Bajaj Finance customer support (86980 10101).

By following these steps, you can easily check your Bajaj loan statement and EMI details, helping you manage your loan effectively and stay on top of your financial commitments.

Bajaj Finserv Loan Foreclosure Online/Process/Download

If you have surplus funds and wish to close your loan early, Bajaj Finserv offers a straightforward online process for loan foreclosure. Here’s a step-by-step guide to help you through the process:

- Sign-In to the Customer Portal: Visit the Bajaj Finserv customer portal and sign in using your mobile number and OTP (One-Time Password). This will give you access to your loan account details.

- Verify Your Identity: Enter your date of birth for verification purposes and proceed to the next step.

- Select the Loan Account: Choose the loan account you wish to foreclose from the list of available options.

- Choose Foreclosure Option: Select the ‘Foreclosure’ option from the payment methods available. You will be shown the outstanding loan amount and any applicable foreclosure charges.

- Review Charges: Carefully review the foreclosure charges and the total amount due. Ensure you understand all the fees involved before proceeding.

- Make the Payment: Proceed with the payment using the available online payment methods. Once the payment is successful, your loan account will be closed.

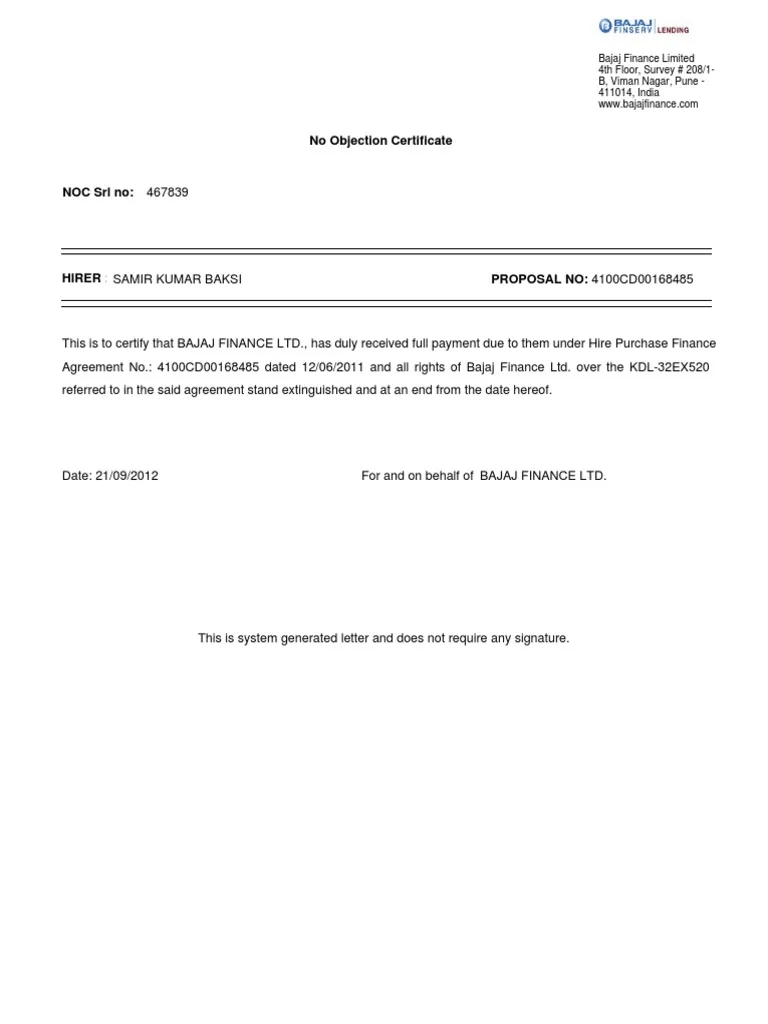

- Download No Dues Certificate: After foreclosure, you can download your no-dues certificate within 48 hours. This certificate confirms that your loan has been successfully closed and there are no outstanding dues.

Benefits of Loan Foreclosure

- Foreclosing your loan can help you save on interest payments and become debt-free faster. By paying off the outstanding amount in one go, you avoid paying additional interest that would accrue over the remaining loan tenure.

Foreclosure Letter Format:

How to Pay Bajaj Emi Online?

Paying your Equated Monthly Installment (EMI) online with Bajaj Finserv is a convenient and hassle-free process. Here’s a step-by-step guide to help you through it:

- Visit the Bajaj Finserv Website: Open your web browser and go to the official Bajaj Finserv website.

- Log In to Your Account: If you already have an account, log in using your username and password. If you don’t have an account, you’ll need to register first.

- Navigate to the EMI Section: Once logged in, navigate to the EMI section on the homepage.

- Choose Your Loan Account: Select the loan account for which you want to make the EMI payment.

- Select the Payment Option: Choose your preferred payment method from the available options, such as net banking, debit/credit cards, UPI, or e-wallets.

- Enter Payment Details: Enter the required payment details, such as your bank account or card information, and the amount you wish to pay.

- Verify the Payment: Review the payment details to ensure everything is correct. Double-check the amount and payment method before proceeding.

- Make the Payment: Click on the “Pay Now” button to complete the transaction. You will receive a confirmation message or email once the payment is successful.

Benefits of Online EMI Payment

- Convenience: Pay your EMIs from the comfort of your home without visiting a branch.

- Security: Bajaj Finserv’s payment gateway ensures secure transactions.

- Multiple Payment Options: Choose from various payment methods that suit your convenience.

- Instant Confirmation: Receive immediate confirmation of your payment via email or SMS.

Bajaj Customer Care

- If you're having trouble accessing your loan details online, you can contact Bajaj Finance customer care (tel: 086980 10101, +91 8698010101). They will be able to assist you and provide the necessary information.

FAQs:

What is loan foreclosure?

- Loan foreclosure means closing your loan early by paying the entire outstanding amount in one installment.

What documents are required for loan foreclosure?

- No documents are required to foreclose your loan with Bajaj Finserv. The process can be completed online through the customer portal.

Can we close a Bajaj loan early?

- You can prepay or foreclose your Bajaj Finance loan by paying the outstanding amount. A foreclosure charge of 4% on the principal amount, along with applicable fees, will apply.

Can I foreclose my Bajaj EMI?

You can foreclose your loan easily by following these steps:

- Sign in to the customer portal using your date of birth, mobile number, and OTP.

- Select the loan account you wish to foreclose.

- Choose the 'Foreclosure' option from the available payment methods.

Are foreclosure fees deductible?

- Yes, foreclosure charges will be deducted as per the bank's policy.

What are the benefits of loan foreclosure?

- Making full prepayment or foreclosure of your existing personal loan is considered beneficial and can increase your CIBIL score. A better credit score can speed up your next loan application process and help you negotiate better terms with the lender.

How long does it take to get the no-dues certificate?

- The no-dues certificate is generated within 48 business hours of foreclosure.

How can I check my Bajaj EMI statement?

- Log in to the Bajaj Finserv EMI statement using your registered details to check your Bajaj Finserv customer portal or mobile app. Navigate to the 'Loan Account' section, select your loan, and download the EMI statement. It provides information on paid EMIs, outstanding balances, and more. You can also request it via email or SMS.

How do I check my Bajaj loan status?

- To check your Bajaj Finserv loan status, log in to the Bajaj Finserv customer portal or mobile app using your registered mobile number or email ID. Navigate to the 'Loan Account' section, where you can view your loan details, including the current status, outstanding balance, and next EMI due date. You can also contact customer support for assistance.

How to pay Bajaj EMI card payment online?

To pay your Bajaj EMI Card payment online, follow these steps:

- Visit the Bajaj Finserv Website: Go to the official Bajaj Finserv website and log in to your account using your credentials.

- Select 'Pay EMI': Navigate to the 'Pay EMI' or 'Quick Pay' option on the website.

- Enter Details: Enter your loan account number, registered mobile number, and the EMI amount.

- Choose Payment Mode: Select your preferred payment method, such as net banking, debit/credit card, UPI, or wallet.

- Confirm Payment: Review the details and confirm the payment. You'll receive a confirmation message upon successful transaction.

How can I pay Bajaj EMI after the due date?

- To pay your Bajaj EMI after the due date, log in to the Bajaj Finserv website or app, and navigate to the 'Pay EMI' section. Enter your details and choose a payment method. Be aware that late fees or penalties may apply. You can also visit a nearby Bajaj Finserv branch or use net banking to complete the payment.

How can I pay EMI directly?

- To pay EMI directly, log in to your lender's website or mobile app, navigate to the EMI payment section, and enter your loan details. Choose your payment method (net banking, debit/credit card, or UPI), and confirm the transaction. Alternatively, you can set up auto-debit for hassle-free payments.

What if I miss my Bajaj EMI?

- If you miss your Bajaj EMI, you may incur late payment fees, increased interest, and a negative impact on your credit score. It's crucial to make the payment as soon as possible to avoid further penalties and maintain your financial health.

We hope you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App

Comments ()