How to Print a Passbook in Sbi Printing Machine?

- Printing your passbook using the SBI Automatic Passbook Printing Machine is a convenient way to keep your account information up-to-date. These machines are available at many SBI branches and allow you to easily print recent transactions and account details. The process is straightforward and user-friendly, designed to provide quick access to your account history without the need for manual intervention by bank staff. Simply follow the on-screen instructions to insert your passbook and update it with the latest entries. This self-service option ensures that you can manage your account efficiently and maintain accurate records of your banking transactions.

Table of Content

- SBI Passbook Print

- SBI Fixed Deposit Scheme

- SBI Fixed Deposit Interest Rate

- How to Apply for SBI Fixed Deposit?

- Important FAQs

SBI Passbook Print

Printing a passbook using an SBI (State Bank of India) passbook printing machine involves a straightforward process. Here's a detailed guide to help you with the steps:

- Visit your nearest SBI branch: Locate the nearest SBI branch equipped with a passbook printing machine.

- Queue up: Join the queue and wait for your turn. If there's a token system, collect your token and wait for your number to be called.

- Provide your passbook: Once it's your turn, present your passbook to the bank officer or at the designated machine.

- Enter your details: If required, enter your account number and other necessary details on the passbook printing machine's screen. Follow the on-screen instructions carefully.

- Choose the transaction: Select the "Passbook Printing" option on the machine.

- Confirm details: Verify that the details displayed on the screen are correct. Make sure that the account number, name, and other relevant information are accurate before proceeding.

- Complete the process: After confirming the details, wait for the printing process to complete. The passbook printing machine will automatically update your passbook with the most recent transactions and account balance.

- Collect your passbook: Once the printing process is finished, retrieve your updated passbook from the machine.

- Verify the entries: Check the entries in your passbook to ensure that all recent transactions have been accurately recorded.

- Confirm completion: Make sure to press the appropriate button on the machine to indicate that the printing process is complete.

- Keep your passbook safe: Store your passbook in a secure place to prevent any damage or loss.

Remember, the exact process might slightly vary depending on the specific passbook printing machine model and the branch's protocols. If you encounter any issues or have difficulty using the machine, don't hesitate to seek assistance from the bank staff. They will be able to guide you through the process and address any concerns you may have.

SBI Fixed Deposit Scheme

The State Bank of India (SBI) offers a reliable Fixed Deposit (FD) scheme that is popular among customers for its guaranteed returns and flexibility. Here are the key details about the SBI Fixed Deposit Scheme, how to apply, and its interest rates:

SBI Fixed Deposit Interest Rate for 2025

| Tenure | Interest Rate (General Public) | Interest Rate (Senior Citizens) |

|---|---|---|

| 7 days to 45 days | 3.50% p.a. | 4.00% p.a. |

| 46 days to 179 days | 5.50% p.a. | 6.00% p.a. |

| 180 days to 210 days | 6.00% p.a. | 6.50% p.a. |

| 211 days to less than 1 year | 6.25% p.a. | 7.00% p.a. |

| 1 year to less than 2 years | 6.80% p.a. | 7.30% p.a. |

| 2 years to less than 3 years | 7.00% p.a. | 7.50% p.a. |

| 3 years to less than 5 years | 6.75% p.a. | 7.25% p.a. |

| 5 years and up to 10 years | 6.50% p.a. | 7.50% p.a. |

Special Tenor Schemes

- Amrit Kalash (400 Days): 7.10% p.a. for the general public and 7.60% p.a. for senior citizens.

- Amrit Vrishti (444 Days): 7.25% p.a. for the general public and 7.75% p.a. for senior citizens.

https://youtu.be/YzjA7QY0vfU?si=qLn9tbgSmEH7I8sL

How to Apply for SBI Fixed Deposit?

Online Application:

- Visit the SBI official website or download the SBI YONO App.

- Log in using your Internet banking credentials or register as a new user.

- Navigate to the "Deposits" section and select "Fixed Deposit."

- Choose the type of FD (Regular FD, Tax-Saving FD, Senior Citizens FD) and enter the required details such as deposit amount and tenure.

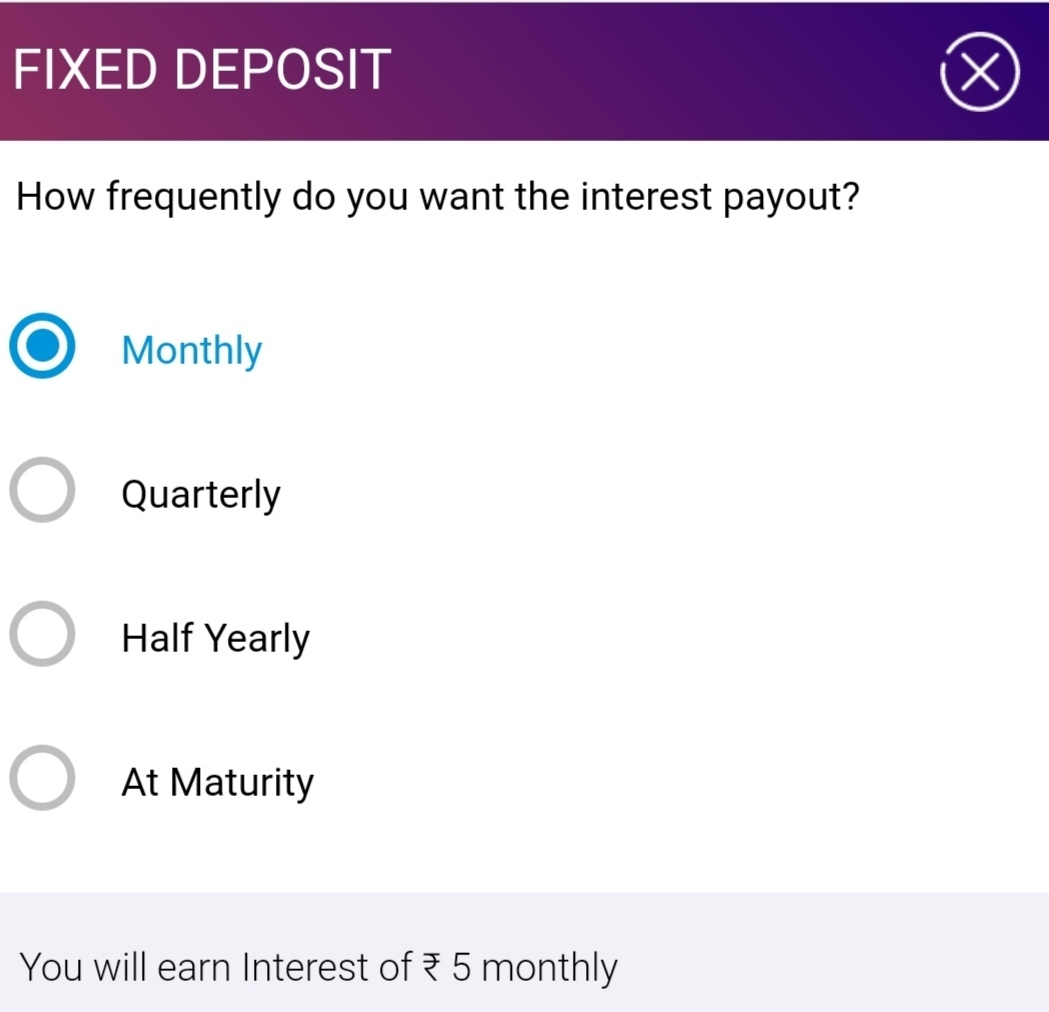

- Select the interest payout option (Cumulative or Non-Cumulative).

- Add a nominee if desired and complete the application process.

Offline Application:

- Visit your nearest SBI branch.

- Fill out the FD application form available at the branch.

- Submit the form along with the required documents and deposit amount.

- The bank representative will guide you through the process and provide you with the necessary details.

Minimum Deposit and Other Features

- Minimum Deposit Amount: ₹1,000.

- Premature Withdrawal Penalty: 0.50% for term deposits up to ₹5 lakh and 1% for term deposits above ₹5 lakh.

- Tax-Saving FD: 6.50% p.a.

- Loan Against Deposit: Available with applicable margin based on the residual tenor of the deposit.

The SBI Fixed Deposit Scheme is an excellent option for individuals looking to invest their savings with assured returns. Whether you are a senior citizen or a general public customer, SBI offers competitive interest rates tailored to different tenures and deposit amounts.

https://youtu.be/__wv43u80bM?si=kei2XuG8GaT9nT4M

FAQs:

Can I print a passbook in an ATM Machine?

- Visit an ATM: Go to an ATM of your bank that offers passbook printing services.

- Insert Your ATM Card: Insert your ATM card into the machine.

- Follow On-Screen Instructions: Follow the on-screen instructions to print your passbook.

What is the process of a passbook printing machine?

The Self Passbook Printing Machine (SPPM) is an automated kiosk that allows customers to print their passbooks on their own.

How it Works:

- The SPPM kiosk recognizes the account details from the magnetic strip placed on the passbook.

- Using these details, the kiosk fetches the account transaction information.

- It then prints the transaction details onto the passbook.

What is the current FD interest rate in SBI?

Here's the table with the requested interest rates:

| Tenure | General Public FD Rate | Senior Citizens FD Rate |

|---|---|---|

| 7 days to 45 days | 3.50% | 4.00% |

| 46 days to 179 days | 5.50% | 6.00% |

| 180 days to 210 days | 6.25% | 6.75% |

| 211 days to less than 1 year | 6.50% | 7.00% |

| 1 Year to less than 2 years | 6.80% | 7.30% |

| 2 years to less than 3 years | 7.00% | 7.50% |

| 3 years to less than 5 years | 6.75% | 7.25% |

| 5 years and up to 10 years | 6.50% | 7.50% |

| 400 Days (Amrit Kalash) | 7.10% | 7.60% |

What is the interest of 1 lakh FD in SBI?

- The interest you earn on a Fixed Deposit (FD) of ₹1 lakh with the State Bank of India (SBI) depends on the tenure and the interest rate applicable to that tenure Interest Rates 2025 - ClearTax]. Here's an example calculation based on the interest rates for 2025:

- Let's assume you invest ₹1 lakh for 2 years at the interest rate of 7.00% p.a. for the general public:

Interest Calculation:

- Principal (P) = ₹1,00,000

- Rate (R) = 7.00% p.a.

- Time (T) = 2 years

Using the formula for simple interest:

{Interest} = P * R * T / 100 ]

{Interest} = [1,00,000 * 7 * 2 / 100 = ₹14,000 ]

So, the total amount at maturity would be:

{Principal + Interest} = [₹1,00,000 + ₹14,000 = ₹1,14,000 ]

What is the limit of FD in SBI?

Minimum and Maximum Deposit Amounts:

- Minimum Deposit Amount: INR 1,000 and in multiples of INR 100 thereafter.

- Maximum Deposit Amount:

- INR 15 lakhs to less than INR 2 crores for retail users.

- INR 2 crores to INR 5 crores for bulk depositors.

SBI Interest Rates on Fixed Deposits (FD):

- The rate of interest is 0.30% higher than the regular fixed deposit rate for a 1-year tenure.

- The rate of interest is 0.40% higher than the regular fixed deposit rate for a 2-year tenure.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App.

Comments ()