How to Take a Loan from Google Pay?

- Google Pay provides business loan facilities by collaborating with various financial institutions. Google Pay, a leading digital payments platform, provides business entrepreneurs with the financial support they need to grow their businesses. Through the Business Loan facility, Google Pay provides financial assistance to small and medium-sized businesses at low interest rates, with quick approval. This allows entrepreneurs to finance their business development, purchase equipment, purchase stock, or meet their working capital needs. Apply digitally for instant, business, or personal loans on the Google Pay for Business app. Important: Loans are brought to you by Google Pay for Business in collaboration with financial institutions. To know how to apply for loans on Google Pay for Business, watch these videos from our YouTube video contributors.

Update Google Pay App:

- Ensure that you have the latest version of the Google Pay app installed on your device. App updates often include new features and services.

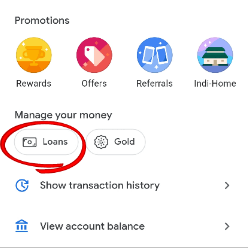

Explore Business Section:

- Open the Google Pay app and navigate to the business or merchant section. Look for any financial services or loan-related features.

Check Eligibility:

- Google Pay, if offering loans, would likely have eligibility criteria. This might include the nature of your business, transaction history, and other relevant factors. Review these criteria to ensure your business qualifies.

Provide Business Information:

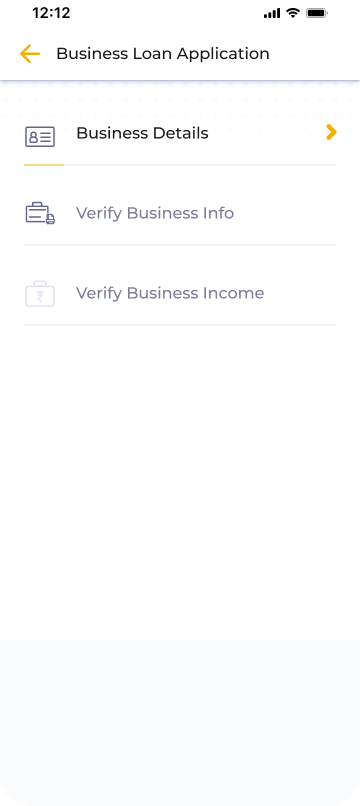

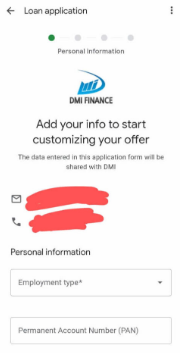

- If there's a loan application process, you may need to provide details about your business, such as its type, size, financial history, and other relevant information.

Terms and Conditions:

- Understand the terms and conditions associated with a loan. This includes interest rates, repayment terms, and any fees associated with the loan.

Application Process:

- Follow the application process outlined in the app. This may involve filling out an online form, submitting documents, and undergoing a verification process.

Wait for Approval:

- After submitting your application, you may need to wait for the approval process to be completed. This can vary in duration.

Receive Funds:

- If approved, you will receive the loan amount in your Google Pay business account or linked bank account.

Google Pay Loan Interest Rate:

- Google Pay, in collaboration with partner banks and NBFCs, offers personal loans with interest rates starting at 13.99% per annum. The actual rate may vary based on factors like your credit score, loan amount, and repayment tenure. With competitive rates and flexible repayment options, Google Pay loans are ideal for quick financial assistance. Borrowers can enjoy a seamless online application process, with instant approval and disbursal directly into their bank account.

FAQs:

Can I get a loan from Google Pay Business?

- Apply digitally for instant, business, or personal loans on the Google Pay for Business app.

Does Google Pay let you borrow money?

- Recently, Google Pay launched an initiative for new-to-credit customers. It has partnered with several banks such as Federal Bank, DMI Finance, etc to offer personal loans to those who do not have a credit history with any bureau.

Is Google Pay business safe or not?

- Google Pay uses an enhanced security platform called “Google Pay Shield” that gives merchants and customers 24/7 security to help detect fraud, prevent hacking, and verify identity.

Is Google Pay loan safe or not

- Yes, Google Pay loans are safe, as they are offered in partnership with trusted banks and NBFCs regulated by the RBI. Ensure you verify the lender details and read the terms before applying.

How can I start the application process for a business loan through Google Pay?

- Download the Google Pay app, navigate to the business or finance section, and select the business loan option to begin your application.

What information do I need to provide for a business loan application on Google Pay?

- You'll need to provide business details (like business name, type, and address), personal information, and financial statements or bank account details linked to your business.

Is a credit check required for a business loan through Google Pay?

- Yes, a credit check is usually required to assess your eligibility and determine the loan terms.

How long does it take to get approval for a business loan from Google Pay?

- The approval time can vary, but applicants can typically expect a response within a few days to a week.

Can I apply for a business loan on Google Pay if I have a new startup?

- Yes, startups can apply, but you may need to provide additional documentation or meet specific criteria to qualify.

What are the interest rates for business loans obtained through Google Pay?

- Loan approvals can be processed quickly, depending on the lender's policies. Google Pay provides competitive interest rates for personal loans, starting at 13.99% per year. This makes it an appealing option for those looking to secure financing efficiently while benefiting from reasonable borrowing costs.

How do I check the status of my business loan application on Google Pay?

- You can check your application status directly in the Google Pay app under the loans or finance section.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App

Comments ()