Navi Instant Personal Loan

What is the Navi Loan App?

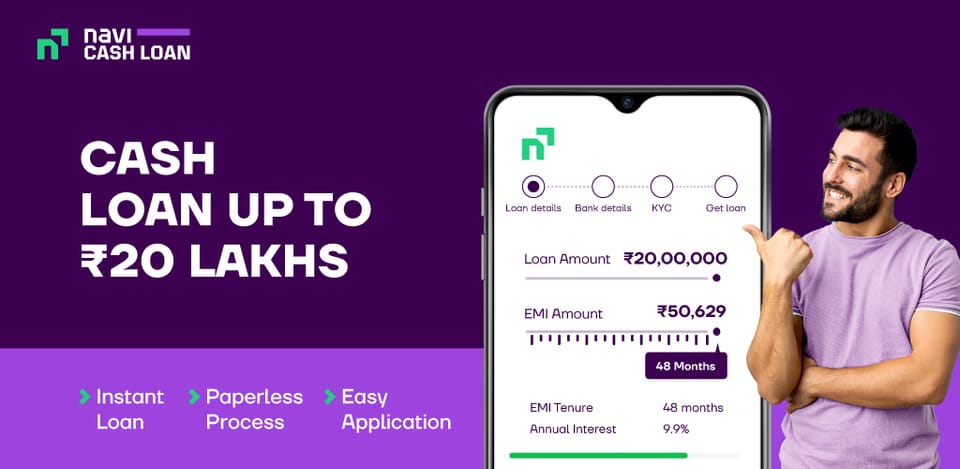

- Navi Instant Personal Loan is a convenient financial solution designed to help individuals meet their immediate financial needs, such as medical emergencies, travel expenses, or unexpected costs. The loan application process is quick and hassle-free, enabling users to secure funds with just a few clicks through the Navi app. With flexible repayment options and competitive interest rates, Navi Instant Personal Loan caters to a wide range of customers.

Key features of Navi Personal Loans

| Feature | Details |

|---|---|

| Interest Rates | Starting at 9.9% p.a. |

| Loan Amount | Up to ₹20 lakh |

| Repayment Tenure | Up to 72 months |

| Processing Fees | 3.99% to 6% of the loan amount |

| Prepayment Charges | Nil |

| Application Process | 100% Paperless |

| Approval and Disbursal | Instant approval and disbursal |

| Collateral Requirement | No collateral required |

| Customer Support | 24/7 support via Navi App |

| Eligibility Criteria | Indian Resident aged 18-65 years, PAN Card Holder, Salaried or Self-Employed, Aadhaar Card Holder |

Navi Loan Eligibility

To be eligible for a Navi Personal Loan, you need to meet the following criteria:

- Indian Resident aged between 18-65 years.

- PAN Card Holder.

- Salaried or Self-Employed.

- Aadhaar Card Holder.

Document Required For Navi Loan

To apply for a Navi Personal Loan, you'll need to provide the following documents:

- PAN Card: A copy of your PAN card for identity verification.

- Address Proof: Any one of the following documents can be used as address proof:

- Aadhaar Card

- Passport

- Voter ID

- Driving License

- Income Proof (for salaried individuals):

- Latest salary slips (3 months)

- Recent bank statements (6 months)

- Income Proof (for self-employed individuals):

- Income Tax Returns (2 years)

- Recent bank statements (6 months)

The process is designed to be quick and hassle-free, ensuring you get access to funds with minimal documentation.

Navi Personal Loan Interest Rate

- Navi Personal Loans offer interest rates starting at 9.9% p.a. The actual interest rate may vary based on your eligibility and credit score.

How to Apply for a Navi Personal Loan?

To get instant personal loans through any app, you generally need to follow these steps.

- Download and Install the App: Visit the official app store for your device (Google Play Store for Android or Apple App Store for iOS). Search for the Navi App and install it.

- Create an Account: Open the app and create an account by providing the required information. This may include personal details, contact information, and sometimes financial information.

- Complete KYC Process: A representative from Navi will call you to complete your KYC verification. You'll need to provide your PAN card and Aadhaar card (optional).

- Link Bank Account: Link your bank account to the app. This is typically done to verify your financial details and facilitate fund transfers.

- Check Eligibility: Most loan apps have an eligibility criteria check. This involves assessing your creditworthiness based on various factors such as income, credit history, and other financial indicators.

- Select Loan Amount and Tenure: Once eligible, you can choose the loan amount and tenure that suits your needs. Be sure to review the interest rates and other terms and conditions.

- Submit Application: Complete the loan application process by providing the necessary information and documentation. This may include income proof, employment details, and other relevant documents.

- Approval and Disbursement: After submitting your application, the app will review it. If approved, the loan amount will be disbursed to your linked bank account.

- Repayment: Repay the loan as per the agreed-upon terms. Most apps have options for monthly EMI payments.

It's important to carefully read the terms and conditions, interest rates, and fees associated with the loan. Additionally, ensure that you are using the official app from a legitimate provider to avoid scams.

Contact Navi App Customer Care Number (If Need)

- You can contact Navi App customer care at 80108-33333 for any queries or assistance. Contact No.: 8147544555 (Only For Registered Customer) or email at: For queries related to other products: contact: [email protected];

Navi App Review

The Navi App has received positive reviews for its user-friendly interface and efficient services. Here are some key points from various reviews:

- User-Friendly Interface: Users appreciate the easy-to-navigate dashboard and seamless application process.

- Instant Loan Approval: The app offers instant loan approvals, making it convenient for users in need of quick funds.

- Flexible Loan Options: Users can choose from a variety of loan options with flexible repayment tenures.

- Wide Range of Services: The app provides services beyond loans, including UPI payments, mutual fund investments, and health insurance.

- Minimal Documentation: The 100% paperless process with minimal documentation is a major plus point.

- Positive Customer Support: Users have reported positive experiences with Navi's customer support team.

FAQs:

Is Navi app safe for loan?

- Navi App is a Secure Application. the Navi App, endorsed by the RBI for digital lending and UPI transactions, prioritizes security. Its user-friendly interface ensures a seamless experience, minimizing errors and confusion throughout the process.

Is Navi Loan App RBI approved?

- Yes, the Navi app is RBI-approved for digital lending and UPI transactions.

What is the interest rate of Navi app?

- Navi provides personal loans with appealing interest rates commencing at 9.9% per annum, along with adaptable EMI choices extending up to 72 months.

Is Navi loan real or fake?

- The Navi Loan App serves as a financial resource to streamline the borrowing process, offering swift access to funds to address urgent financial requirements, and emphasizing reliability.

Does Navi provide personal loans?

- Yes, Navi does provide personal loans. They offer competitive interest rates starting at 9.9% p.a., flexible repayment options with tenures ranging from 12 to 72 months, and a 100% paperless application process. The Navi App makes it easy to apply for and manage your loan with instant approval and disbursal.

We hope that you like this content and for more such content Please follow us on our social site and YouTube and subscribe to our website.

Manage your business cash flows and payable/receivables using our Bahi Khata App

Comments ()